Tokenomics 101: Understanding the Value Drivers of New Cryptos

In the rapidly evolving world of cryptocurrency, understanding the underlying economics that drive new projects is crucial for making informed investment decisions. Tokenomics plays a pivotal role in this analysis, providing insights into the factors that determine the value and utility of a particular cryptocurrency.

Concept of Tokenomics

Tokenomics is a multidisciplinary concept that combines principles from economics, game theory, and computer science. It involves the study of how the issuance, distribution, and utilization of tokens within a blockchain network affect the project’s value and long-term sustainability.

Key Value Drivers of Crypto Tokens

Several crucial factors influence the value of a crypto token:

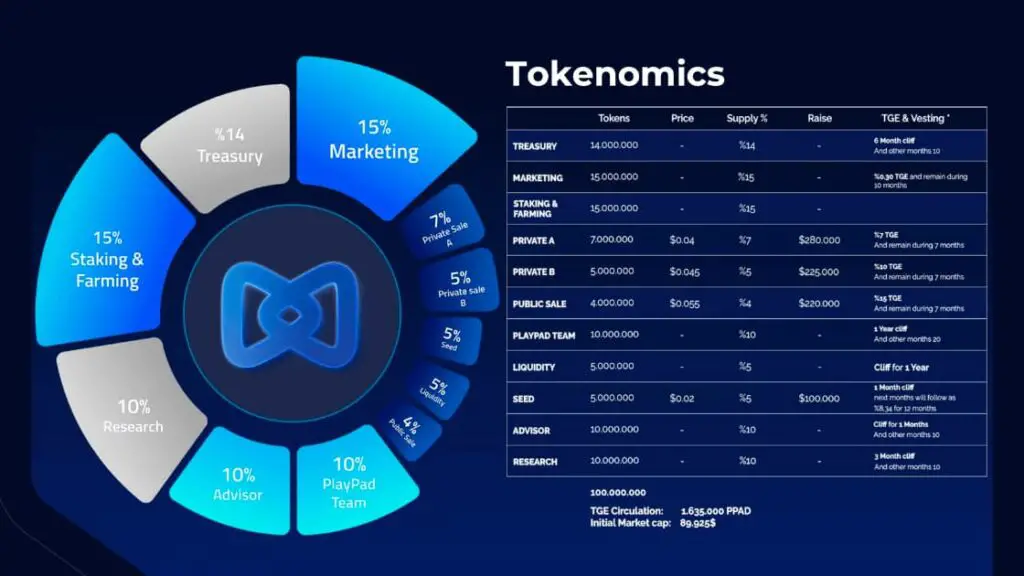

- Token Supply and Distribution: The total number of tokens in circulation, their distribution among different stakeholders, and the release schedule can impact scarcity and perceived value.

- Utility: The inherent usefulness and functionality of the token within the project’s ecosystem are essential for sustained demand.

- Governance Rights: Some tokens grant holders governance rights, allowing them to participate in decision-making and influence the future direction of the project.

- Incentives and Network Effects: Tokens can be designed to incentivize desired behaviors, such as participation in validation or content creation, fostering a positive feedback loop and increasing network value.

- Speculation and Hype: In nascent markets, speculation and media hype can temporarily inflate token prices, showcasing the importance of considering fundamental value drivers alongside market sentiment.

Importance of Tokenomics

Understanding tokenomics provides several benefits:

- Informed Investment Decisions: It allows investors to assess the intrinsic value of a cryptocurrency and make informed decisions based on its economic characteristics.

- Project Viability Assessment: By analyzing the distribution and usage of tokens, investors can evaluate the long-term viability and potential growth of a project.

- Risk Management: Understanding the tokenomics helps investors identify and mitigate potential risks associated with the investment, such as inflation or security vulnerabilities.

- Market Trend Analysis: Tracking tokenomics trends can provide insights into market dynamics and identify emerging opportunities for profit maximization.

Conclusion

Tokenomics is a vital aspect of any cryptocurrency project that provides valuable insights into its value drivers. Understanding the key factors that influence token value allows investors to make informed decisions, assess project viability, manage risk, and capitalize on emerging market trends. By embracing tokenomics as a fundamental pillar of crypto analysis, investors can navigate the complex and dynamic landscape of digital currencies with greater confidence and success.