The Tokenization of Everything: New Cryptocurrencies and the Digital Economy

The tokenization of everything is a new trend in the digital economy that is set to have a major impact on the way we interact with the world. Tokens are digital assets that represent ownership of something, such as a share in a company, a piece of property, or even a digital good. They can be traded and exchanged like traditional currencies, but they also have some unique properties that make them well-suited for the digital economy.

There are a number of reasons why the tokenization of everything is happening now. First, the development of blockchain technology has made it possible to create and track tokens in a secure and transparent way. Second, the rise of the internet of things (IoT) is creating a world where everything is connected and can be represented by a token. Third, the increasing popularity of decentralized autonomous organizations (DAOs) is creating a need for new ways to manage and govern online communities.

The tokenization of everything has a number of potential benefits. First, it can make it easier to own and trade assets. Second, it can create new opportunities for investment and growth. Third, it can help to empower individuals and communities by giving them more control over their own affairs.

However, there are also some risks associated with the tokenization of everything. First, it can lead to increased speculation and volatility in the markets. Second, it can create new opportunities for fraud and abuse. Third, it can raise concerns about privacy and data security.

Overall, the tokenization of everything is a major trend that is set to have a significant impact on the digital economy. It has the potential to create new opportunities for investment, growth, and empowerment. However, it is also important to be aware of the risks involved and to take steps to mitigate them.## The Tokenization Of Everything: New Cryptocurrencies And The Digital Economy

Executive Summary

The tokenization of everything is a major trend that is poised to revolutionize the way we interact with the digital economy. By tokenizing assets, we can create new markets, reduce friction, and increase transparency. This article will explore the tokenization of everything, its benefits, and its potential use cases.

Introduction

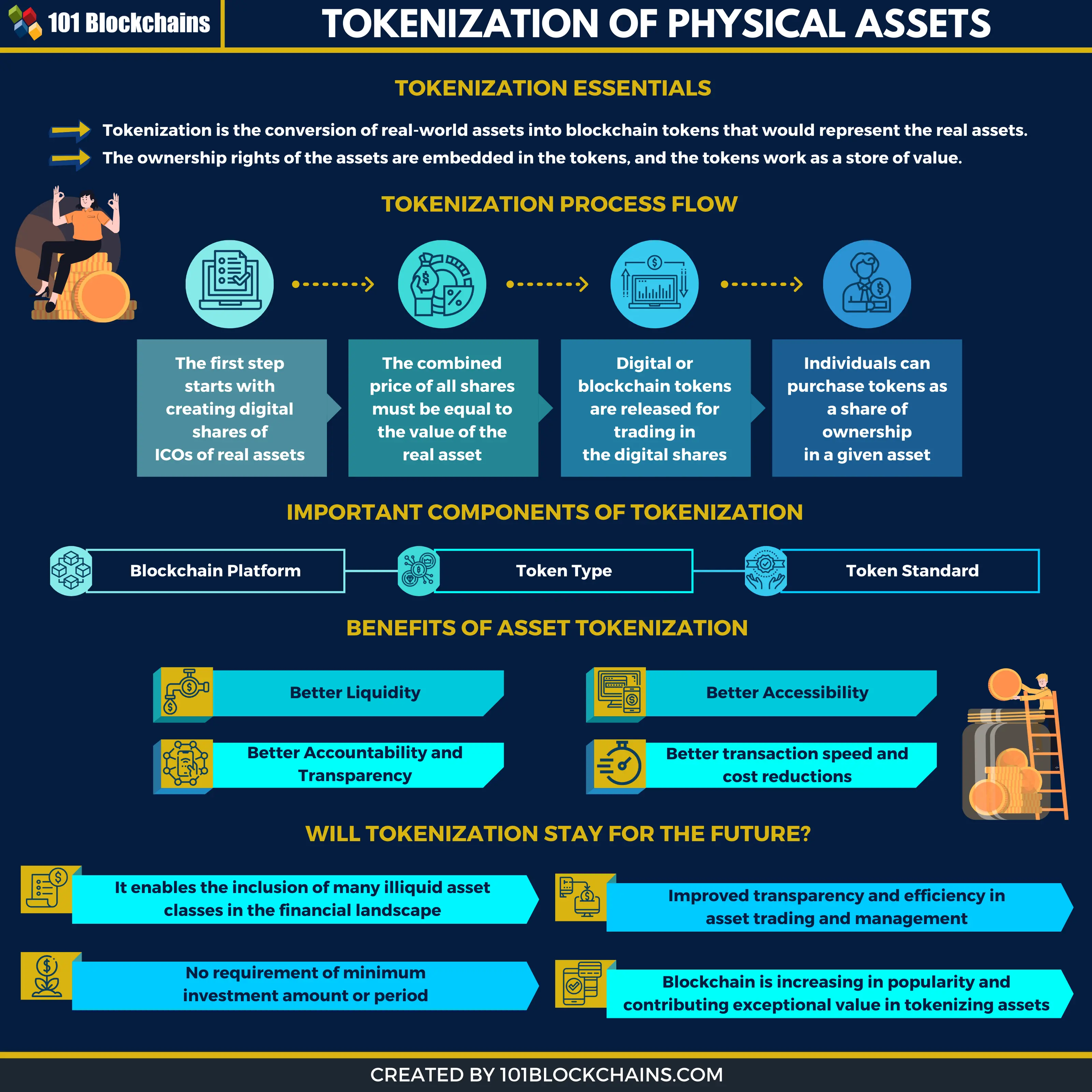

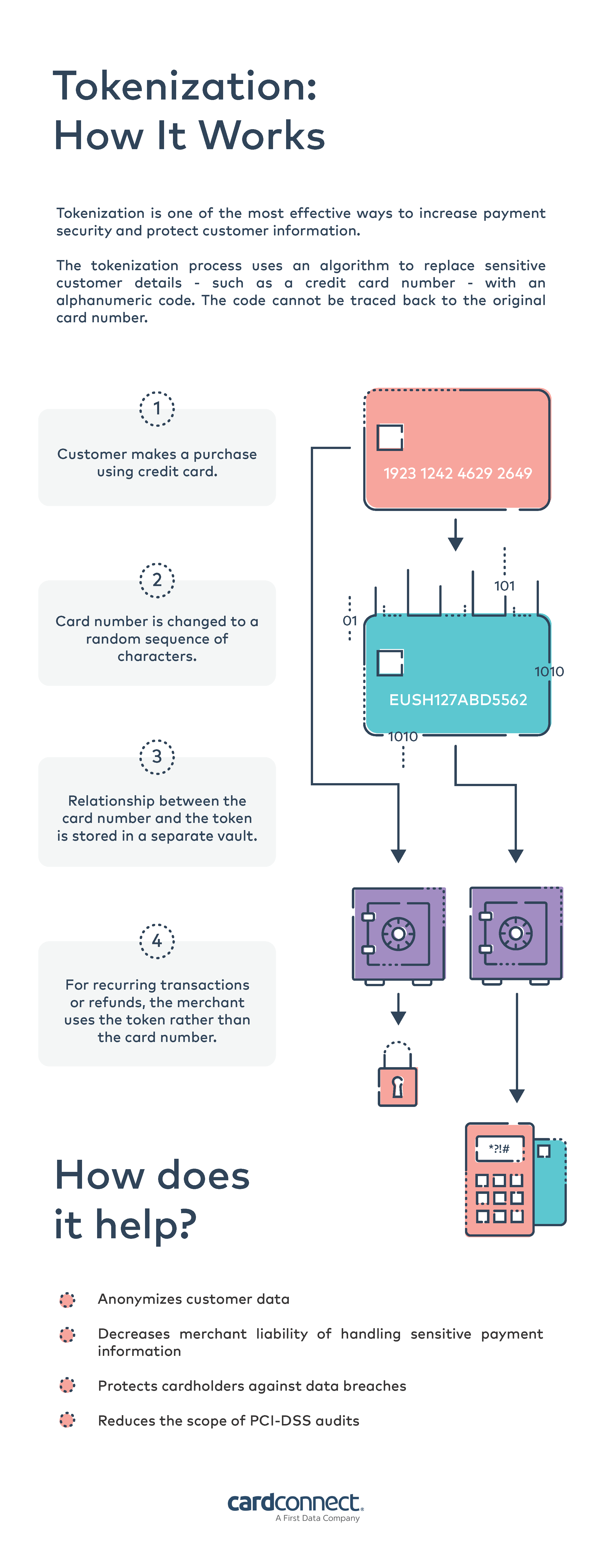

The tokenization of everything is the process of converting assets into digital tokens. These tokens can then be used to represent ownership, access, or other rights to the underlying asset. Tokenization has the potential to disrupt a wide range of industries, from finance to real estate to healthcare.

FAQs

- What is tokenization?

Tokenization is the process of converting assets into digital tokens. - What are the benefits of tokenization?

Tokenization can create new markets, reduce friction, and increase transparency. - What are some potential use cases for tokenization?

Tokenization can be used to tokenize everything from real estate to artwork to carbon credits.

Key Subtopics

Tokenization of Assets

The tokenization of assets is the process of converting assets into digital tokens. These tokens can then be used to represent ownership, access, or other rights to the underlying asset. Asset tokenization has the potential to revolutionize a wide range of industries, from finance to real estate to healthcare.

- Benefits of asset tokenization:

- Fractional Ownership: Tokenized assets can be divided into smaller units, allowing investors to own a fraction of an asset that they would not otherwise be able to afford.

- Increased Liquidity: Tokenized assets can be traded on digital exchanges, making them more liquid than traditional assets.

- Lower Transaction Costs: Tokenized asset transactions can be processed on blockchains, which are more efficient and less expensive than traditional payment systems.

- Increased Transparency: Asset tokenization can increase transparency by providing a public record of all transactions.

- Use Cases for asset tokenization:

- Real estate: Tokenization can make real estate more accessible to investors and provide new opportunities for fractional ownership.

- Equity and debt: Tokenization can create new markets for equity and debt, making it easier for companies to raise capital.

- Art and Collectibles: Tokenization can provide new ways to own and trade art and collectibles, opening up new markets for these asset classes.

- Carbon credits: Tokenization can create a new market for carbon credits, making it easier to track and trade these credits.

Security Token Offerings (STOs)

Security Token Offerings (STOs) are a type of crowdfunding that uses blockchain technology. STOs allow companies to raise capital by selling digital tokens that represent ownership or other rights in the company. STOs offer a number of advantages over traditional crowdfunding methods such as ICOs, including increased regulatory compliance and more robust investor protections.

- Benefits of STOs

- Increased regulatory compliance: STOs are regulated by the SEC, which provides greater investor protection than ICOs.

- More robust investor protections: STOs offer a number of investor protections, including the right to vote, the right to receive dividends, and the right to redeem the tokens for the underlying asset.

- Access to a wider pool of investors: STOs can be offered to a wider pool of investors than ICOs, including institutional investors and wealthy individuals.

- Uses Cases for STOs

- Company fundraising: STOs can be used by companies to raise capital for a variety of purposes, such as product development, marketing, and expansion.

- Real estate investment: STOs can be used to tokenize real estate projects, allowing investors to own a stake in the development or operation of the property.

- Equity and debt investment: STOs can be used to create new markets for equity and debt, making it easier for companies to raise capital and for investors to find new investment opportunities.

Utility Tokens

Utility tokens are a type of cryptocurrency that is used to access a particular good or service. Utility tokens are often used to reward users for their participation in a network or platform. Unlike security tokens, utility tokens do not represent ownership or other rights in the company.

- Benefits of utility tokens:

- Increased user engagement: Utility tokens can be used to incentivize users to participate and contribute to a network or platform.

- Reduced transaction costs: Utility tokens can be used to pay for goods and services within a network or platform, reducing transaction costs.

- Enhanced security: Utility tokens can be used to secure a network or platform by requiring users to stake tokens in order to participate.

- Use Cases for utility tokens:

- Gaming: Utility tokens can be used to reward players for their participation in a game or to purchase in-game items.

- Social media: Utility tokens can be used to reward users for creating and sharing content on a social media platform.

- Decentralized applications: Utility tokens can be used to pay for access and usage of decentralized applications.

- Cloud computing: Utility tokens can be used to pay for access and usage of cloud computing services.

Stablecoins

Stablecoins are a type of cryptocurrency that is designed to maintain a stable value, often pegged to a government-backed currency such as the U.S. dollar. Stablecoins offer a number of advantages over traditional cryptocurrencies such as bitcoin, including reduced volatility, increased stability, and wider acceptance for payments.

- Benefits of stablecoins:

- Reduced Volatility: Stablecoins are designed to maintain a stable value, reducing the risk of losing value due to price fluctuations.

- Increased stability: Stablecoins are backed by a reserve of assets, which provides stability during times of market volatility.

- Wider acceptance: Stablecoins are being adopted by a growing number of businesses and merchants, making it easier for people to use.

- Uses Cases for stablecoins:

- Payments: Stablecoins can be used to make payments for goods and services, reducing the risk of price volatility.

- Remittances: Stablecoins can be used to send remittances to other countries, making the process faster, cheaper, and more transparent.

- Investment: Stablecoins can be used as a hedge against price volatility in the cryptocurrency market.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies (CBDCs) are digital versions of fiat currencies issued by central banks. CBDCs offer a number of advantages over traditional fiat currencies, including increased security, reduced transaction costs, and wider accessibility.

- Benefits of CBDCs:

- Increased security: CBDCs are issued and backed by central banks, which provides a high level of security and trust.

- Reduced transaction costs: CBDCs can be transacted on blockchains, which are more efficient and less expensive than traditional payment systems.

- Wider accessibility: CBDCs can be used by anyone with a smartphone or internet access, making them more accessible than traditional fiat currencies.

- Uses Cases for CBDCs

- Domestic payments: CBDCs can be used to make domestic payments, reducing the need for cash and traditional banking services.

- Cross-border payments: CBDCs can be used to make cross-border payments, making the process faster, cheaper, and more transparent.

- Financial inclusion: CBDCs can be used to provide financial inclusion to people who do not have access to traditional banking services.

Conclusion

The tokenization of everything is still in its early stages, but it has the potential to revolutionize the way we interact with the digital economy. By tokenizing assets, we can create new markets, reduce friction, and increase transparency. The key subtopics discussed in this article provide a foundation for understanding the tokenization of everything and its potential use cases.

Keywords

- Tokenization

- Cryptocurrency

- Digital Economy

- Security Token Offering (STO)

- Stablecoin

- Utility Token

- Central Bank Digital Currency (CBDC)