The Impact of Blockchain on Traditional Banking: Disruption or Integration?

Executive Summary

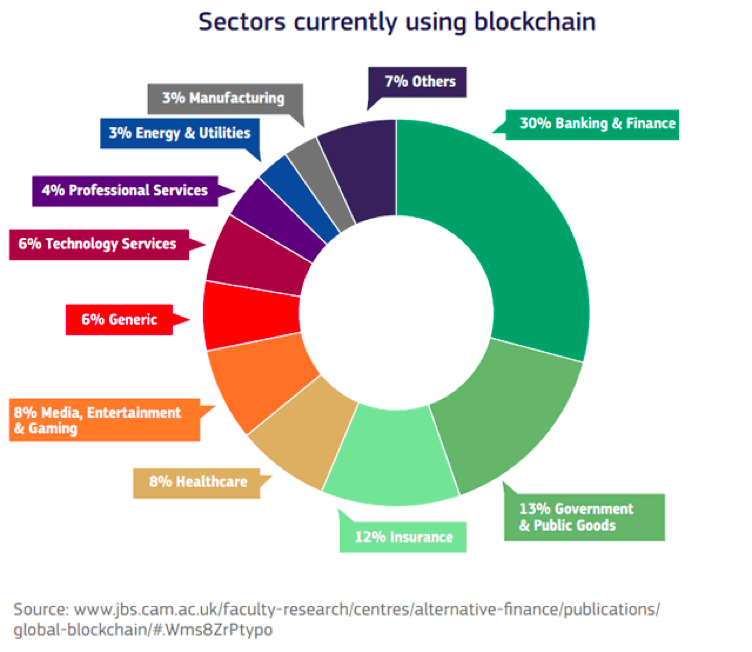

The advent of blockchain technology has sparked a surge of speculation surrounding its potential impact on the banking industry. While some posit that blockchain will revolutionize banking, others believe it will merely complement existing systems. This article provides a comprehensive examination of the likely implications of blockchain on traditional banking, exploring both the potential for disruption and the opportunities for integration.

Introduction

Blockchain, often hailed as the technology underpinning Bitcoin, is a distributed ledger system characterized by its immutability, transparency, and decentralization. These distinct attributes have given rise to substantial interest in blockchain’s potential to reshape industries, including banking.

Subtopics

1. Decentralization and Trust

Central to blockchain’s value proposition is its decentralized nature, eliminating the need for intermediaries in financial transactions. This trustless system enables parties to engage in transactions directly, reducing transaction costs and increasing efficiency.

- Removes intermediaries: Eliminates middlemen, enhancing privacy and reducing transaction fees.

- Promotes transparency: Provides auditable records of all transactions, offering improved accountability.

- Enhances data security: Distributes data across a network of computers, making it highly resistant to hacking.

2. Cross-Border Payments

Blockchain’s ability to facilitate seamless cross-border payments addresses the challenges of traditional bank-to-bank transfers, which often involve lengthy processing times and significant fees.

- Accelerates transactions: Enables near-instantaneous settlement of payments across borders.

- Reduces costs: Streamlines the payment process, eliminating the need for intermediaries and their associated charges.

- Improves transparency: Provides real-time visibility into the status of payments, reducing counterparty risk.

3. Smart Contracts

Smart contracts, self-executing contracts enforced and monitored by blockchain, introduce innovative solutions to banking processes. They enhance efficiency and reduce the potential for error and fraud.

- Automates processes: Reduces manual workload and enhances accuracy through predetermined conditions and automated execution.

- Enforces compliance: Embedded compliance rules ensure adherence to regulations, mitigating risk.

- Facilitates tailored solutions: Allows the creation of bespoke contracts, addressing specific business needs.

4. Credit Management

Blockchain leverages immutable transaction records to revolutionize credit management processes. Transparent data enables more informed risk assessments, while smart contracts facilitate automated loan issuance and repayments.

- Enhances risk management: Access to reliable transaction histories allows lenders to assess creditworthiness more accurately.

- Automates loan processes: Streamlines lending processes, improving efficiency and reducing turnaround times.

- Reduces paperwork: Digitalization and automation minimize paperwork and facilitate faster loan approvals.

5. New Financial Products

Blockchain empowers banks and fintech companies to develop innovative financial products, leveraging its trustless and decentralized nature. These products offer new opportunities for revenue generation and customer engagement.

- Digital assets: Allows the tokenization of assets, providing greater accessibility and liquidity.

- Cryptocurrency integration: Opens doors to cryptocurrency integration, providing new payment methods and investment options.

- Banking-as-a-service: Facilitates partnerships between banks and fintech companies, enabling tailored financial solutions.

Conclusion

While the full impact of blockchain on traditional banking remains to be seen, its potential for disruption and integration is undeniable. By embracing its transformative capabilities, banks can improve efficiency, reduce costs, and enhance customer satisfaction. However, a balanced approach is crucial, acknowledging both the risks and opportunities associated with blockchain. As the technology matures and regulatory frameworks evolve, the banking industry is poised for a significant transformation driven by this transformative technology.

Keyword Tags

- Blockchain

- Traditional Banking

- Decentralization

- Smart Contracts

- Cryptocurrency

FAQs

Q: Will blockchain replace traditional banks?

A: Unlikely. Instead, blockchain will likely complement existing banking systems, enhancing efficiency and providing new opportunities.

Q: How will blockchain impact bank employees?

A: Blockchain may lead to automation of certain tasks, but it will also create new opportunities related to blockchain development, analysis, and consulting.

Q: Are blockchain-based financial transactions secure?

A: Blockchain’s decentralized and immutable nature makes transactions highly secure, but it is important for banks to implement robust security measures to protect customer data.

Q: What are the regulatory challenges posed by blockchain in banking?

A: Regulators are still grappling with blockchain’s implications, but efforts are underway to develop appropriate frameworks that balance innovation with consumer protection.

Q: How can banks prepare for the blockchain revolution?

A: Banks should explore pilot projects, invest in research, and collaborate with fintech companies to stay ahead of the curve.