The Global Perspective: How New Cryptocurrencies Are Received Around The World

The rise of new cryptocurrencies has been met with a mixed reception around the world. In some countries, such as the United States, there is a great deal of interest in cryptocurrencies, and a number of businesses accept them as payment. In other countries, such as China, there is more skepticism about cryptocurrencies, and their use is more restricted.

There are a number of factors that affect how new cryptocurrencies are received in different countries. One factor is the regulatory environment. In countries with a more favorable regulatory environment, such as the United States, it is easier for businesses to accept cryptocurrencies and for consumers to use them. In countries with a more restrictive regulatory environment, such as China, it is more difficult for businesses to accept cryptocurrencies and for consumers to use them.

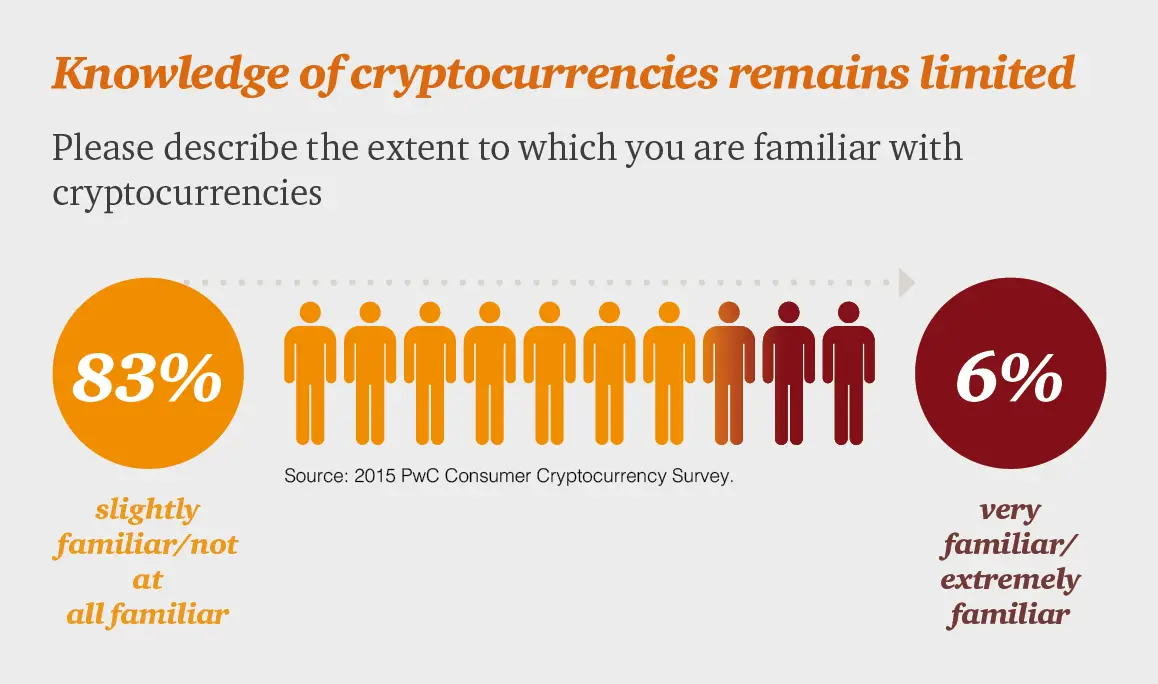

Another factor that affects how new cryptocurrencies are received is the level of financial literacy. In countries with a high level of financial literacy, such as the United States, people are more likely to understand how cryptocurrencies work and how to use them. In countries with a low level of financial literacy, such as China, people are more likely to be skeptical about cryptocurrencies and less likely to use them.

Finally, the cultural context of a country can also affect how new cryptocurrencies are received. In countries with a more individualistic culture, such as the United States, people are more likely to be interested in using cryptocurrencies as a way to achieve financial independence. In countries with a more collectivist culture, such as China, people are more likely to be interested in using cryptocurrencies as a way to support their community.

Overall, the reception to new cryptocurrencies around the world is mixed. There are a number of factors that affect how new cryptocurrencies are received, including the regulatory environment, the level of financial literacy, and the cultural context of a country.The Global Perspective: How New Cryptocurrencies Are Received Around The World

Executive Summary

The world of cryptocurrencies is constantly evolving, with new projects emerging all the time. While some new cryptocurrencies are met with great enthusiasm, others are met with skepticism or even hostility. In this article, we will take a look at how new cryptocurrencies are received around the world. We will examine the factors that influence public opinion, and we will discuss the various challenges that new cryptocurrencies face.

Introduction

Cryptocurrencies are a relatively new phenomenon, and their long-term impact on the global economy is still unknown. However, there is no doubt that cryptocurrencies have the potential to revolutionize the way we think about money and finance. As new cryptocurrencies continue to emerge, it is important to understand how they are being received around the world.

FAQs

1. What are the most important factors that influence public opinion about new cryptocurrencies?

Several factors influence public opinion about new cryptocurrencies, including volatility, security, and regulation. Volatility refers to the price fluctuations of a cryptocurrency, which can be a significant deterrent for some investors. Concerns over security are also common, as cryptocurrencies are still a relatively new technology and are vulnerable to hacking and fraud. Finally, regulation is a key factor that can shape public opinion. If a cryptocurrency is well-regulated, it is more likely to be seen as a legitimate investment opportunity.

2. What are the challenges that new cryptocurrencies face?

New cryptocurrencies face several challenges, including competition, regulation, and adoption. Competition is fierce in the cryptocurrency market, where numerous projects are vying for attention and funding. Regulation is also a challenge, as governments around the world are still grappling with how to regulate cryptocurrencies. Finally, adoption is a key challenge for new cryptocurrencies, as they need to be widely accepted in order to be successful.

3. What is the future of new cryptocurrencies?

The future of new cryptocurrencies is uncertain. However, there is no doubt that cryptocurrencies have the potential to revolutionize the way we think about money and finance. As new cryptocurrencies continue to emerge, it will be important to monitor their development and to stay informed about the latest trends in the cryptocurrency market.

Top 5 Subtopics

Volatility

Volatility is one of the most important factors that influence public opinion about new cryptocurrencies. Volatility refers to the price fluctuations of a cryptocurrency, which can be a significant deterrent for some investors.

-

High volatility: New cryptocurrencies are often highly volatile, which means that their prices can fluctuate wildly in a short period of time. This can make it difficult for investors to predict the future value of a cryptocurrency, and it can also lead to significant losses.

-

Low volatility: Some cryptocurrencies experience relatively low volatility, which means that their prices do not fluctuate as much. This can make them a more attractive investment option for risk-averse investors.

-

Causes of volatility: The volatility of a cryptocurrency can be influenced by several factors, including: the supply and demand for the currency; the liquidity of the market; the news and events surrounding the currency; and the overall market sentiment.

Security

Security is another important factor that influences public opinion about new cryptocurrencies. Concerns over security are also common, as cryptocurrencies are still a relatively new technology and are vulnerable to hacking and fraud.

-

Strong security: New cryptocurrencies that have strong security measures in place are more likely to be seen as a legitimate investment opportunity. Some of the features that contribute to strong security include: strong encryption, a distributed ledger, and a team of experienced developers.

-

Weak security: New cryptocurrencies that have weak security measures in place are more likely to be targeted by hackers and fraudsters. Some of the vulnerabilities that can lead to weak security include: weak encryption, a centralized ledger, and a lack of experience and expertise.

-

Importance of security: Security is essential for the long-term success of any cryptocurrency. If a cryptocurrency is not secure, it is vulnerable to attack, which can lead to the loss of investor funds.

Regulation

Regulation is a key factor that can shape public opinion about new cryptocurrencies. If a cryptocurrency is well-regulated, it is more likely to be seen as a legitimate investment opportunity.

-

Clear regulation: New cryptocurrencies that are subject to clear and well-defined regulations are more likely to be seen as a legitimate investment opportunity. Some of the key issues that regulations should address include: the issuance of new coins, the trading of cryptocurrencies, and the use of cryptocurrencies for illegal activities.

-

Unclear regulation: New cryptocurrencies that are subject to unclear or poorly defined regulations are more likely to be seen as a risky investment. This is because investors are less likely to invest in a cryptocurrency if they are not sure how it will be regulated in the future.

-

Importance of regulation: Regulation is essential for the long-term success of any cryptocurrency. Clear and well-defined regulations provide investors with confidence and help to protect them from fraud and abuse.

Adoption

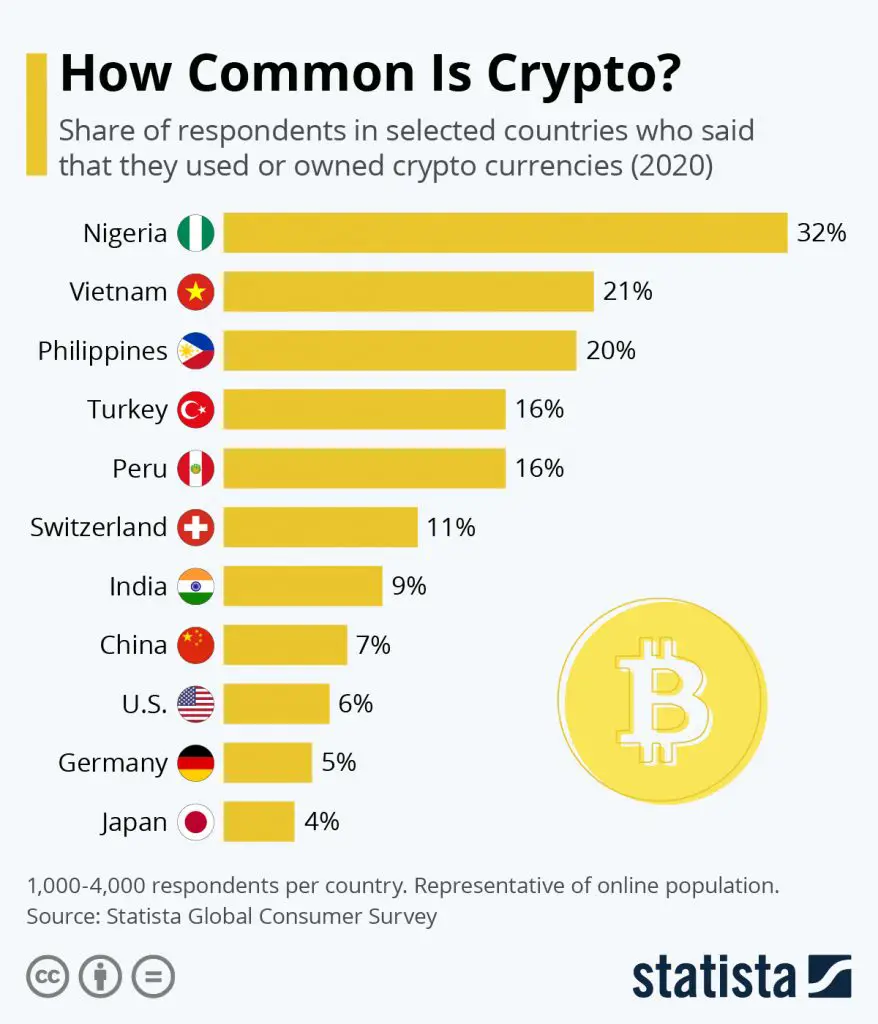

Adoption is a key challenge for new cryptocurrencies, as they need to be widely accepted in order to be successful.

-

Widespread adoption: New cryptocurrencies that are widely adopted are more likely to be seen as a legitimate investment opportunity. Some of the factors that can contribute to widespread adoption include: the usefulness of the cryptocurrency, the ease of use, and the availability of the cryptocurrency on exchanges.

-

Limited adoption: New cryptocurrencies that have limited adoption are less likely to be seen as a legitimate investment opportunity. This is because investors are less likely to invest in a cryptocurrency if they do not believe that it will be widely used.

-

Importance of adoption: Adoption is essential for the long-term success of any cryptocurrency. If a cryptocurrency is not widely adopted, it is unlikely to be able to sustain its value.

Competition

Competition is fierce in the cryptocurrency market, where numerous projects are vying for attention and funding.

-

High competition: New cryptocurrencies that face high competition are less likely to be successful. This is because investors are more likely to invest in cryptocurrencies that have a unique value proposition and a strong competitive advantage.

-

Low competition: New cryptocurrencies that face low competition are more likely to be successful. This is because investors are more likely to invest in cryptocurrencies that have a clear path to success.

-

Importance of competition: Competition is healthy for the cryptocurrency market as it drives innovation and keeps prices competitive.

Conclusion

The global perspective on new cryptocurrencies is mixed. In some countries, new cryptocurrencies are welcomed with open arms, while in others, they are met with skepticism or even hostility. However, there is no doubt that cryptocurrencies have the potential to revolutionize the way we think about money and finance. As new cryptocurrencies continue to emerge, it will be important to monitor their development and to stay informed about the latest trends in the cryptocurrency market.

Relevant keyword tags

- New cryptocurrencies

- Global perspective

- Volatility

- Security

- Regulation

- Adoption

- Competition