The Generational Divide: How Different Age Groups View New Cryptocurrencies

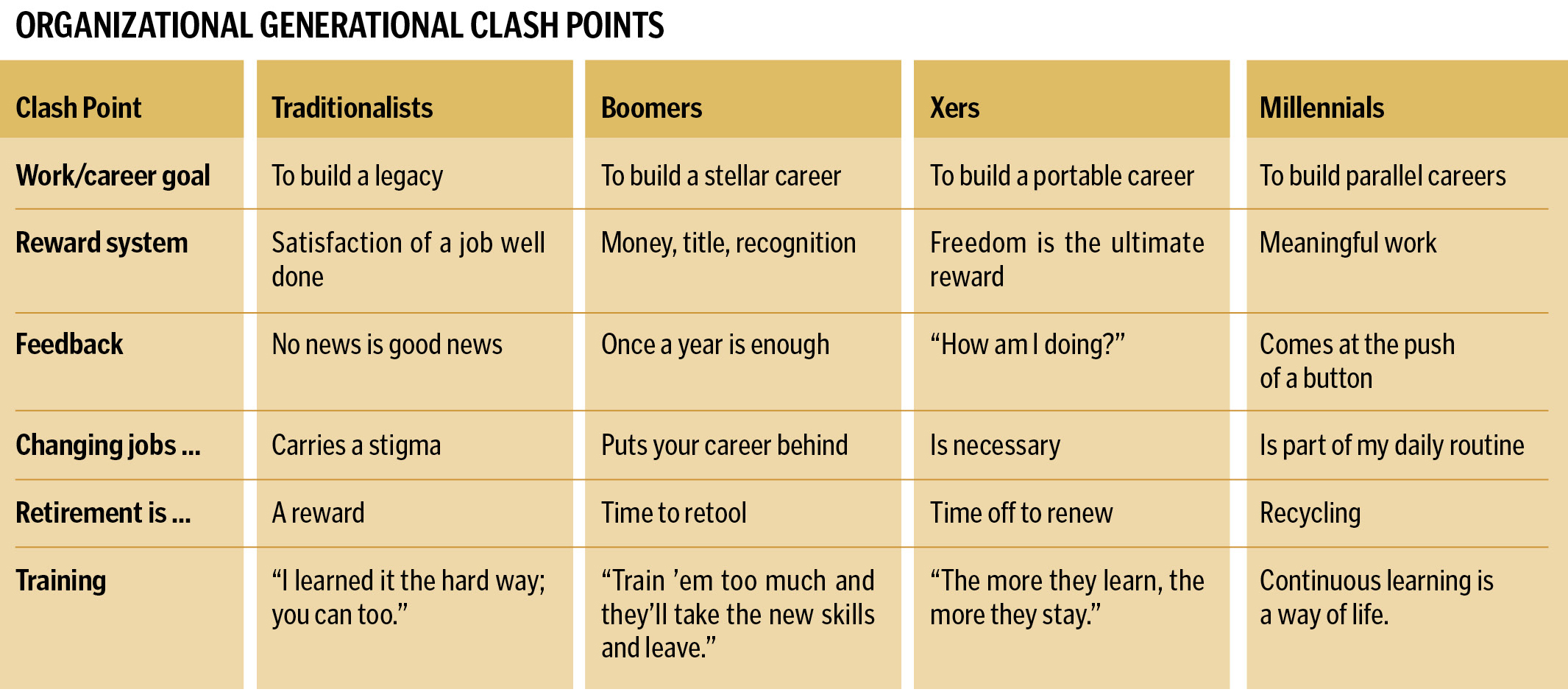

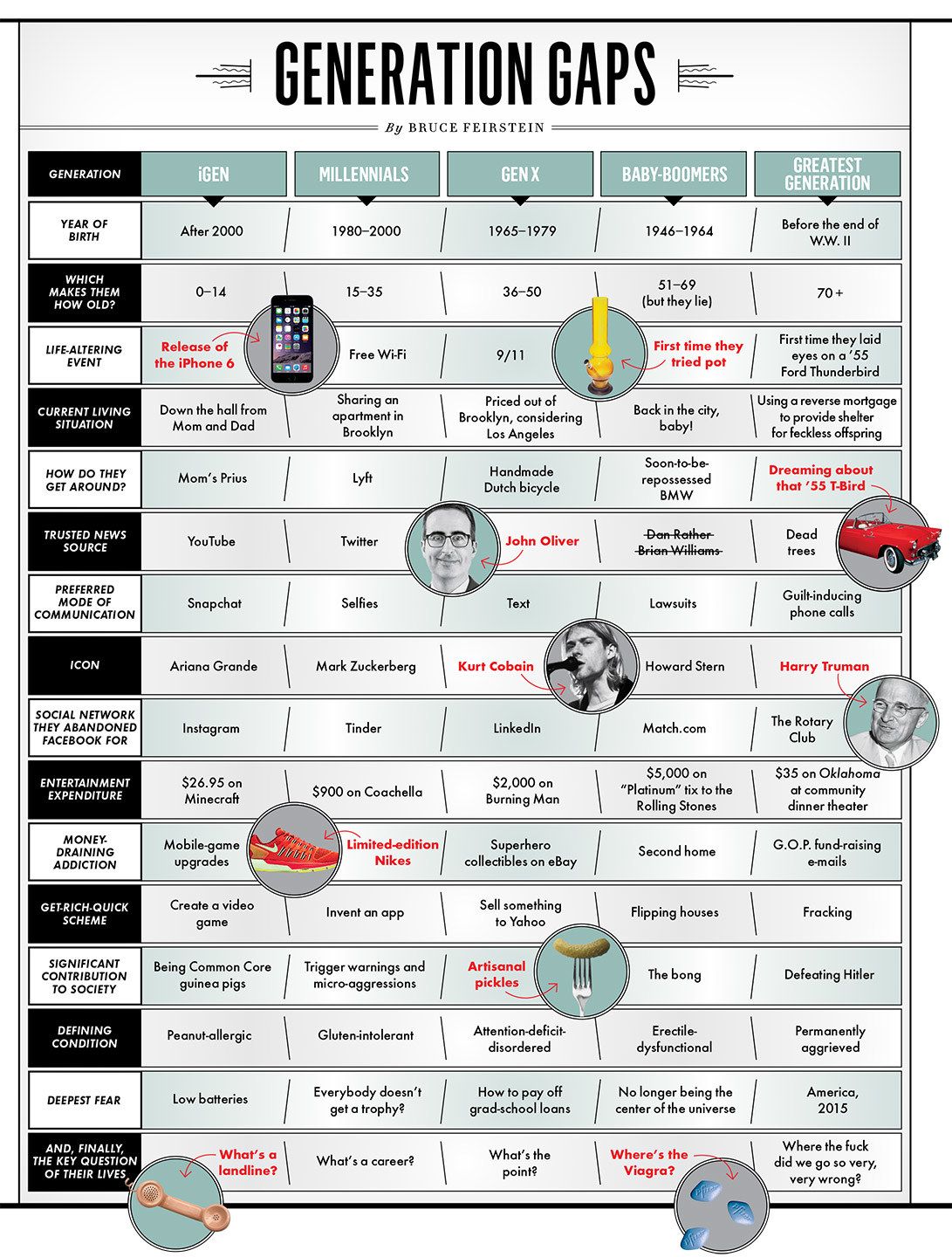

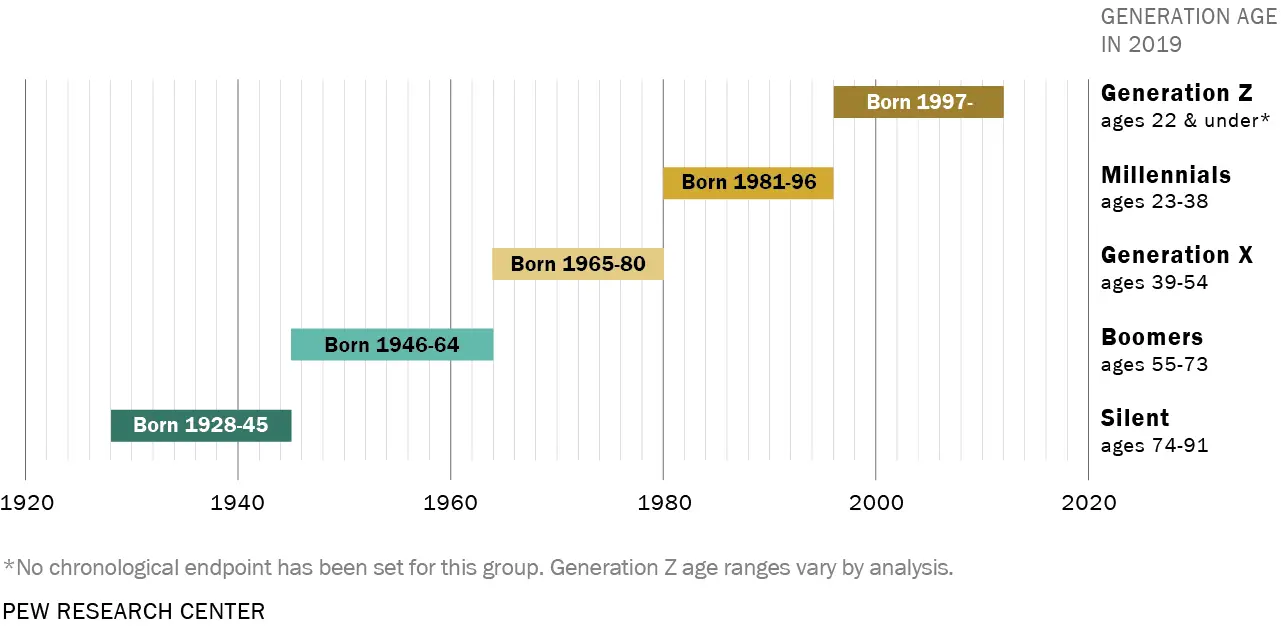

The rise of new cryptocurrencies has created a generational divide in how different age groups view these digital assets. Younger generations, who have grown up with technology, are more familiar with cryptocurrencies and see them as potential investments or a means of payment. Older generations, on the other hand, are more skeptical and hesitant to embrace these new technologies.

Younger Generations: Embracing Cryptocurrencies

Younger generations, such as Millennials and Gen Z, are more likely to see cryptocurrencies as a legitimate investment opportunity. They are more comfortable with technology and have a greater understanding of how these digital assets operate. They are also more likely to be involved in online communities and social media platforms where cryptocurrencies are discussed and promoted.

Older Generations: Skepticism and Caution

Older generations, such as Baby Boomers and the Silent Generation, are more skeptical of cryptocurrencies. They are less familiar with their underlying technology and may view them as risky or volatile investments. They are also more likely to trust traditional financial institutions and government-backed currencies.

Factors Influencing Generational Views

Several factors contribute to the generational divide in views on cryptocurrencies. These include:

- Technological literacy: Younger generations are more technologically literate and have greater experience with digital platforms, making them more comfortable with cryptocurrencies.

- Investment goals: Millennials and Gen Z are more likely to prioritize growth and potential returns in their investments, making them more willing to take risks on new assets like cryptocurrencies.

- Financial knowledge: Older generations have more financial experience and are more risk-averse, leading them to be more cautious about investing in cryptocurrencies.

- Media exposure: Younger generations are more likely to be exposed to positive portrayals of cryptocurrencies through social media, news outlets, and online forums.

- Peer influence: Younger generations are more influenced by peers who share their views and experiences with cryptocurrencies.

Bridging the Generational Gap

Understanding the generational divide is crucial for companies and financial institutions that wish to attract and engage all customer segments. To bridge the gap, they need to:

- Provide education and information: Educate older generations about cryptocurrencies, their underlying technology, and potential benefits.

- Address concerns: Address common concerns of older generations, such as security risks, volatility, or lack of regulation.

- Offer tailored products: Create investment products and services that cater to the specific needs and risk tolerance of different age groups.

- Foster dialogue: Engage with both younger and older generations to understand their perspectives and address misconceptions.

- Respect differences: Recognize and respect the generational differences in attitudes towards cryptocurrencies.

By addressing the generational divide, companies and financial institutions can appeal to a broader range of customers and promote a more inclusive approach to investing in cryptocurrencies.