The Evolution of Decentralized Finance (DeFi): Opportunities and Challenges

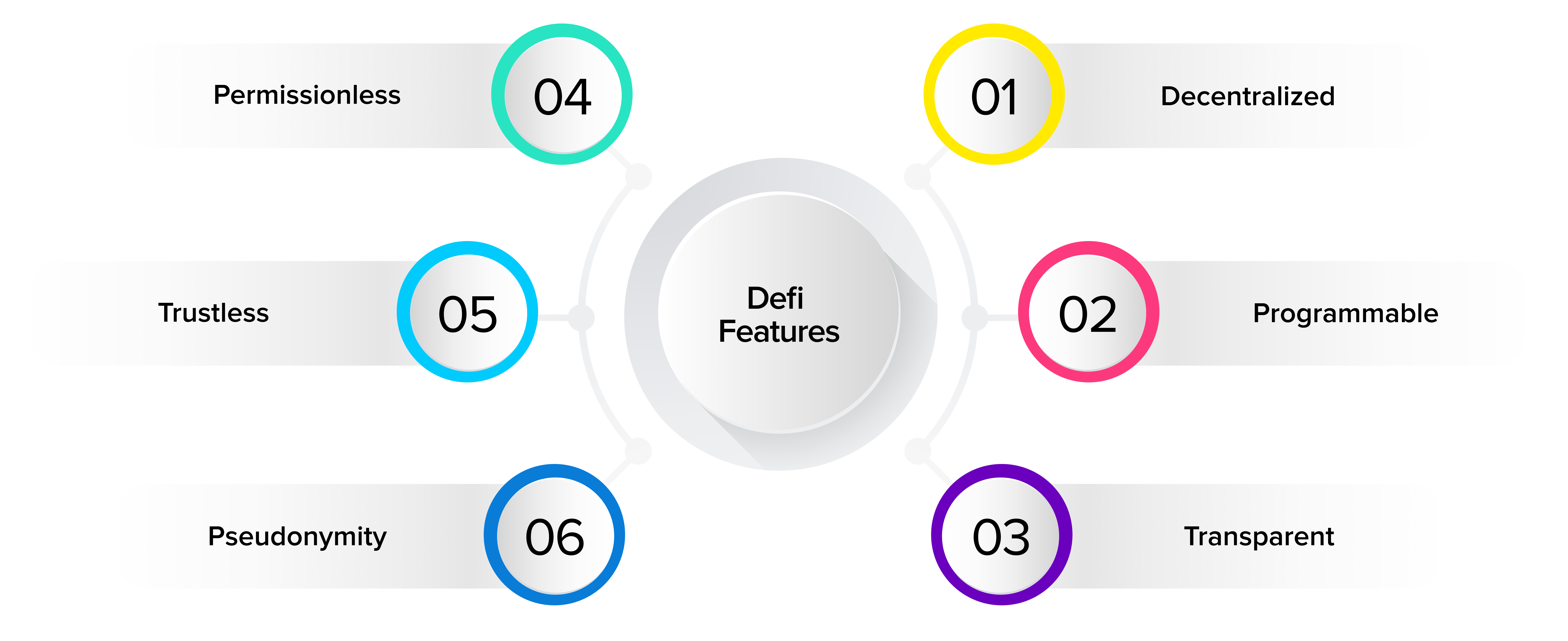

Decentralized Finance (DeFi) has emerged as a rapidly evolving sector within the cryptocurrency ecosystem. It encompasses a suite of financial applications and protocols built on public blockchains, aiming to provide alternative and democratized access to financial services. The evolution of DeFi has created both immense opportunities and challenges, shaping the trajectory of the digital finance landscape.

Opportunities:

- Increased Accessibility: DeFi platforms enable individuals to access financial services without the need for traditional intermediaries, such as banks or brokerages. This increased accessibility extends opportunities to individuals in regions with limited or unreliable financial infrastructure.

- Transparency and Auditability: DeFi protocols operate on blockchain networks, providing transparency and auditability. Transactions are recorded on immutable ledgers, ensuring accountability and reducing the risk of financial fraud.

- Innovation and Experimentation: The decentralized nature of DeFi allows for rapid innovation and experimentation. Developers can create new applications and protocols without the need for regulatory approval or oversight.

- Enhanced Security: DeFi protocols leverage the security of underlying blockchains to safeguard user assets. Distributed ledger technology and cryptographic mechanisms provide robust protection against hacking and unauthorized access.

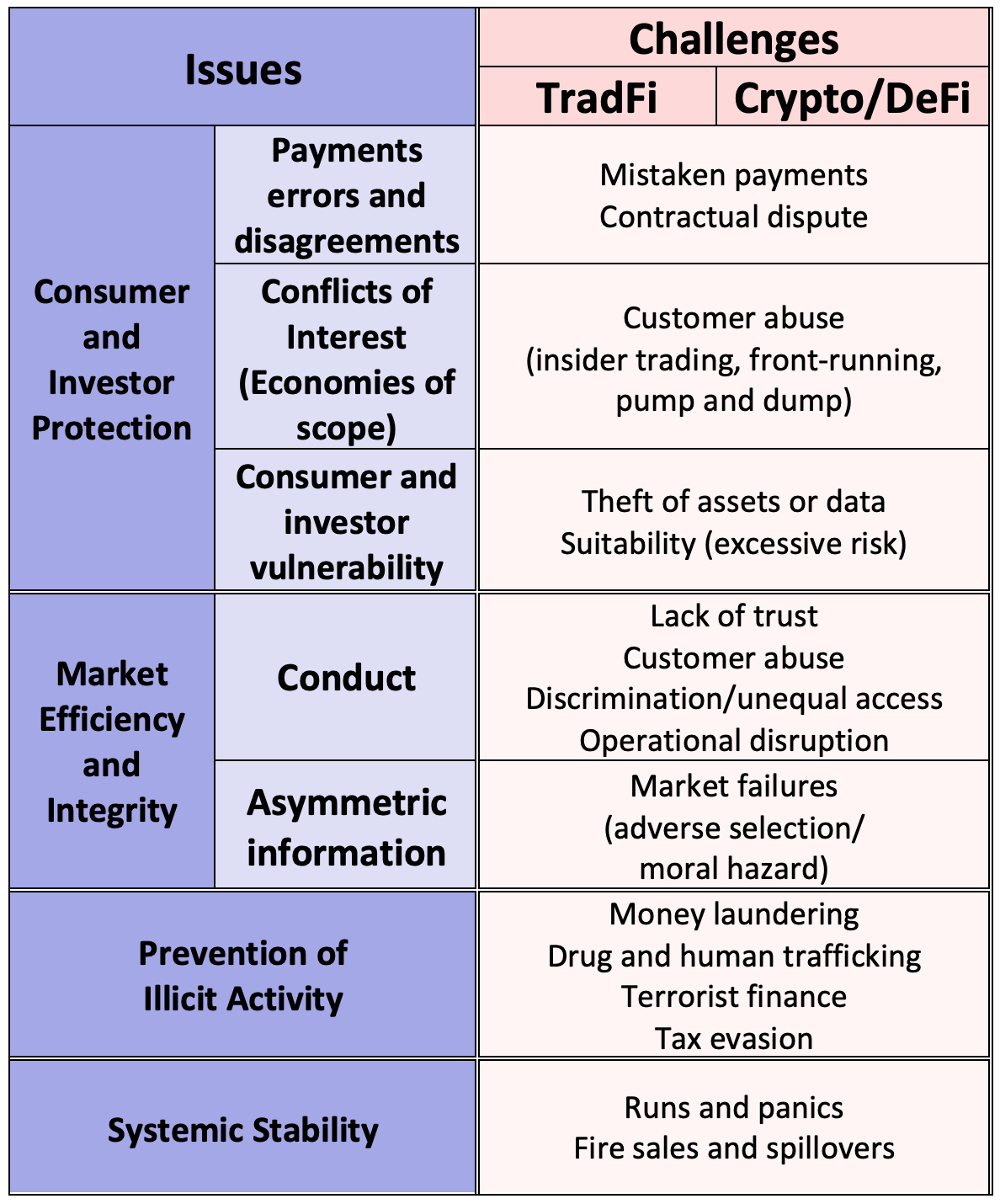

Challenges:

- Regulatory Uncertainty: The regulatory landscape for DeFi is still evolving. Governments and regulators grapple with how to classify DeFi projects and apply existing regulations or develop new ones. This uncertainty can hinder the growth and adoption of DeFi.

- Security Vulnerabilities: While DeFi protocols are generally secure, they are not immune to vulnerabilities. Smart contracts, the code underlying DeFi applications, can contain errors or exploits that can be leveraged by hackers to steal or manipulate user funds.

- Complexity and Usability: DeFi applications can be complex and challenging to use for non-technical users. The lack of user-friendly interfaces and simplified protocols can limit the adoption and accessibility of DeFi.

- Scalability and Interoperability: The demand for DeFi services can strain blockchain networks, leading to congestion and increased transaction fees. Additionally, the fragmentation of DeFi protocols across different blockchains creates interoperability challenges.

Despite these challenges, the potential of DeFi remains significant. By addressing regulatory uncertainties, enhancing security measures, improving usability, and promoting scalability and interoperability, DeFi has the potential to transform the financial industry, empowering individuals with more control over their finances and unlocking novel financial opportunities.## The Evolution Of Decentralized Finance (defi): Opportunities and Challenges

Executive Summary

Decentralized finance (DeFi) is a rapidly growing segment of the financial industry that uses blockchain technology to remove intermediaries and give users more control over their money. DeFi offers a wide range of opportunities for investors and users, but it also comes with some challenges that need to be addressed. This guide will cover the evolution of DeFi, its benefits and challenges, and top subtopics relevant and insightful for anyone looking to learn more about the space.

Introduction

Decentralized finance (DeFi) is a new type of financial system that uses blockchain technology to eliminate the need for intermediaries. This makes it possible for people to lend, borrow, and trade money without having to go through a bank or other financial institution. DeFi is still in its early stages of development, but it has the potential to revolutionize the financial industry and transform the way we think about money.

DeFi Subtopics

1. Lending and Borrowing

DeFi lending and borrowing protocols allow users to lend and borrow money without having to go through a bank. This is made possible by smart contracts, which are self-executing contracts that are stored on the blockchain. DeFi lending and borrowing platforms offer a number of advantages over traditional banking, including lower interest rates, faster transaction times, and greater transparency.

- Loans are typically over-collateralized and backed by crypto assets.

- Interest rates are usually floating and determined by supply and demand.

- Users can borrow against their crypto assets without having to sell them.

2. Decentralized Exchanges (DEXs)

DEXs are peer-to-peer marketplaces that allow users to trade cryptocurrencies directly with each other. This eliminates the need for a centralized exchange, which can be hacked or shut down. DEXs offer a number of advantages over centralized exchanges, including lower trading fees, greater security, and more privacy.

- DEXs use automated market makers (AMMs) to facilitate trades.

- AMMs use smart contracts to set prices and execute trades.

- DEXs are non-custodial, meaning that users retain control of their private keys.

3. Stablecoins

Stablecoins are cryptocurrencies that are pegged to a fiat currency, such as the US dollar. This makes them much less volatile than other cryptocurrencies, which makes them ideal for use as a medium of exchange or store of value. Stablecoins offer a number of advantages over traditional fiat currencies, including lower transaction fees, faster settlement times, and greater accessibility.

- Stablecoins are backed by fiat currency or other crypto assets.

- Stablecoins are designed to maintain a stable value relative to the underlying asset.

- Stablecoins can be used to make payments, send remittances, or hedge against volatility.

4. Decentralized Insurance

DeFi insurance protocols allow users to purchase insurance against the risk of loss or theft. This is made possible by smart contracts, which can be used to automate the claims process and ensure that payouts are made quickly and efficiently. DeFi insurance offers a number of advantages over traditional insurance, including lower premiums, greater transparency, and more flexibility.

- DeFi insurance policies are typically parametric, meaning that they pay out based on a specific event occurring.

- DeFi insurance policies are often more affordable than traditional insurance policies.

- DeFi insurance policies can be purchased and managed online, making them more accessible.

5. Yield Farming

Yield farming is a way to earn rewards by lending or providing liquidity to DeFi protocols. This can be a great way to earn passive income, but it is also important to be aware of the risks involved. Yield farming can be volatile, and there is always the risk of losing money.

- Yield farming can be done on a variety of platforms.

- Users can earn rewards in the form of tokens or cryptocurrency.

- Yield farming can be a complex and time-consuming process.

Conclusion

DeFi is a rapidly evolving field with the potential to revolutionize the financial industry. While there are some challenges that need to be addressed, such as scalability, regulation, and security, DeFi offers a number of unique opportunities for investors and users. As the technology continues to mature, DeFi is likely to become more widely adopted and play an increasingly important role in the global financial system.

Keyword Phrase Tags

- Decentralized finance (DeFi)

- DeFi lending

- DeFi borrowing

- DeFi exchanges

- DeFi insurance

Ths article provides a comprehensiv overview of the evoluton of DeFi. It highlights the key opportunites and challenges facing the industry. A must-read for anyone interested in the future of finance!!

I’m not so sure about DeFi. It sounds like a lot of hype to me. I’m not convinced that it’s going to revolutionize the financial industry.

The article does a good job of explaining the technical aspects of DeFi. It’s clear that the author has a deep understanding of the subject matter.

I disagree with the author’s assessment of the risks associated with DeFi. I believe that the risks are more significant than the author makes them out to be.

DeFi is the future of finance. Just don’t tell your bank that.

Oh, DeFi is going to revolutionize the financial industry? Yeah, right.

DeFi is like a roller coaster. It’s exciting, but you’re not sure if you’re going to make it to the end.

DeFi is the most exciting thing to happen to finance since the invention of the internet.

I’m cautiously optimistic about DeFi. I think it has the potential to revolutionize the financial industry, but there are still some challenges that need to be addressed.

I hope that DeFi will make it easier for people to access financial services.