The Economic Implications Of Cryptocurrency Adoption: Insights From New Coins

The advent of new cryptocurrencies has significant economic implications that warrant exploration. These novel digital assets offer unique characteristics and functionalities that can reshape various aspects of the global financial landscape. Here are key economic implications to consider:

-

Market Fragmentation: The proliferation of new coins leads to market fragmentation, as they compete for users, developers, and resources. This can reduce the dominance of established cryptocurrencies like Bitcoin and Ethereum and create opportunities for smaller networks to gain traction.

-

Diversification: The availability of various cryptocurrencies allows investors to diversify their portfolios, reducing risks associated with a single coin. This diversification can enhance market stability and attract new participants.

-

Competition: The presence of new coins introduces competition within the cryptocurrency market, driving innovation and efficiency. Developers are incentivized to improve their networks’ technology, security, and usability to attract users.

-

Speculation: New cryptocurrencies often attract speculative investors who seek quick profits. This can lead to price volatility, market manipulation, and potential financial losses. However, it can also stimulate market activity and drive adoption.

-

Use Cases Expansion: New coins can expand the use cases of cryptocurrencies beyond traditional financial applications. They may offer specialized features for payments, decentralized finance (DeFi), supply chain management, and other industries.

-

Adoption Drivers: The emergence of new coins can provide additional incentives for cryptocurrency adoption by addressing specific needs and attracting new user groups. It can catalyze wider acceptance and mainstream integration.

Insights from new coins can provide valuable perspectives on these economic implications. By analyzing the adoption patterns, market dynamics, and technological innovations associated with new cryptocurrencies, researchers and policymakers can gain a deeper understanding of the evolving digital asset landscape. This knowledge can inform strategies for managing the risks and seizing the opportunities presented by cryptocurrency adoption.## The Economic Implications Of Cryptocurrency Adoption: Insights From New Coins

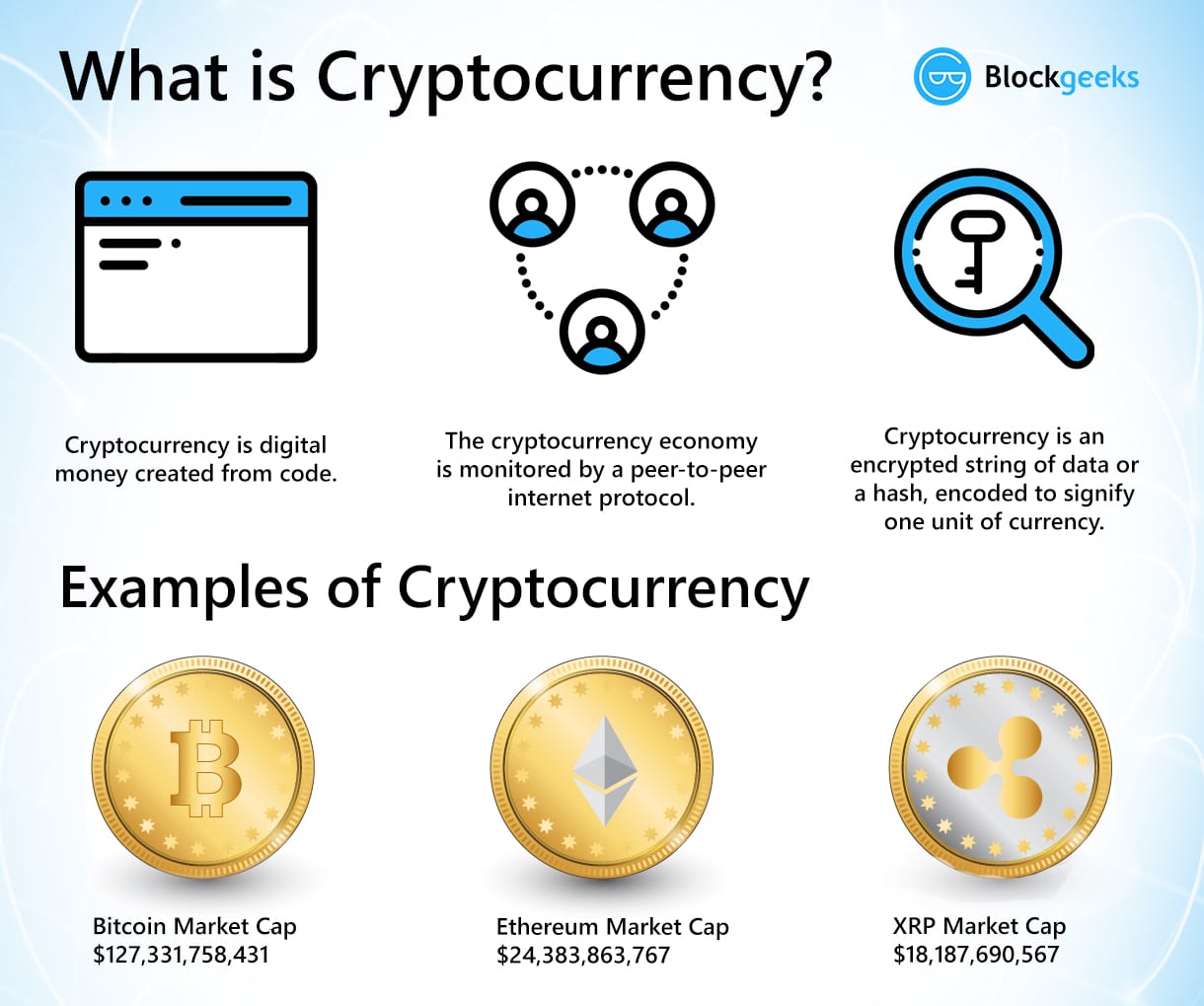

Ever since its inception, Cryptocurrency has been a topic of intense debate and analysis, with experts and economists delving into its implications and significance. Most notably is the introduction of new crypto coins and the substantial impact they have had on the global economy. This article will be providing you with 5 key economic implications that emerged from the adoption of new crypto coins.

Executive Summary

This article assesses the economic implications of adopting new crypto coins, highlighting their impact on market volatility, investment diversity, financial inclusion, monetary stability, and regulatory frameworks. It emphasizes the potential benefits of cryptocurrencies in fostering economic growth while acknowledging the challenges faced in ensuring stability and minimizing risks.

Introduction

The advent of new cryptocurrencies has ushered in a transformative era in the financial realm. These digital assets have garnered significant attention, warranting a thorough examination of their impact on the global economy. This article aims to provide a comprehensive analysis of the economic implications associated with the adoption of new crypto coins.

Key Economic Implications

1. Market Volatility

- High Volatility: Crypto coins exhibit substantial price fluctuations, posing significant risks for investors.

- Factors Influencing Volatility: Demand and supply dynamics, regulatory uncertainties, and media sentiment contribute to price volatility.

- Mitigation Strategies: Diversification, risk management tools, and stablecoins can help reduce volatility.

2. Investment Diversity

- Asset Diversification: Crypto coins offer a new asset class, diversifying investment portfolios and potentially reducing overall risk.

- Unique Return Profile: Cryptocurrencies have a low correlation with traditional investments, providing diversification benefits.

- Investment Accessibility: Crypto coins enable retail investors to access previously restricted alternative asset classes.

3. Financial Inclusion

- Access to Banking Services: Crypto coins provide financial inclusion to unbanked populations and those in developing countries.

- Cross-Border Transactions: Cryptocurrencies facilitate fast and cost-efficient cross-border payments.

- Financial Empowerment: Crypto coins empower individuals with greater control over their finances and access to financial services.

4. Monetary Stability

- Decentralized Currency: Crypto coins are decentralized and not controlled by central authorities, potentially challenging monetary stability.

- Inflationary Concerns: The creation of new crypto coins can contribute to inflationary pressures.

- Central Bank Intervention: Central banks may intervene to maintain monetary stability and safeguard financial systems.

5. Regulatory Frameworks

- Regulatory Uncertainties: The lack of clear regulatory frameworks creates uncertainty for investors and businesses.

- Regulatory Compliance: Governments are working to establish regulations that protect investors and prevent illicit activities.

- Adoption Challenges: Regulatory complexities can hinder the widespread adoption of crypto coins.

Conclusion

The adoption of new crypto coins has brought about significant economic implications, both positive and negative. While these digital assets offer potential benefits for market volatility, investment diversity, financial inclusion, monetary stability, and regulatory frameworks, it remains crucial to address associated risks and uncertainties. As the crypto market continues to evolve, policymakers, regulators, and industry participants must collaborate to establish clear frameworks and foster responsible innovation that maximizes the benefits while minimizing the risks.

Keyword Tags

- Cryptocurrency Adoption

- New Crypto Coins

- Economic Implications

- Market Volatility

- Financial Inclusion