The Anatomy of a Pump and Dump: The Risks Surrounding New Cryptocurrencies

Executive Summary

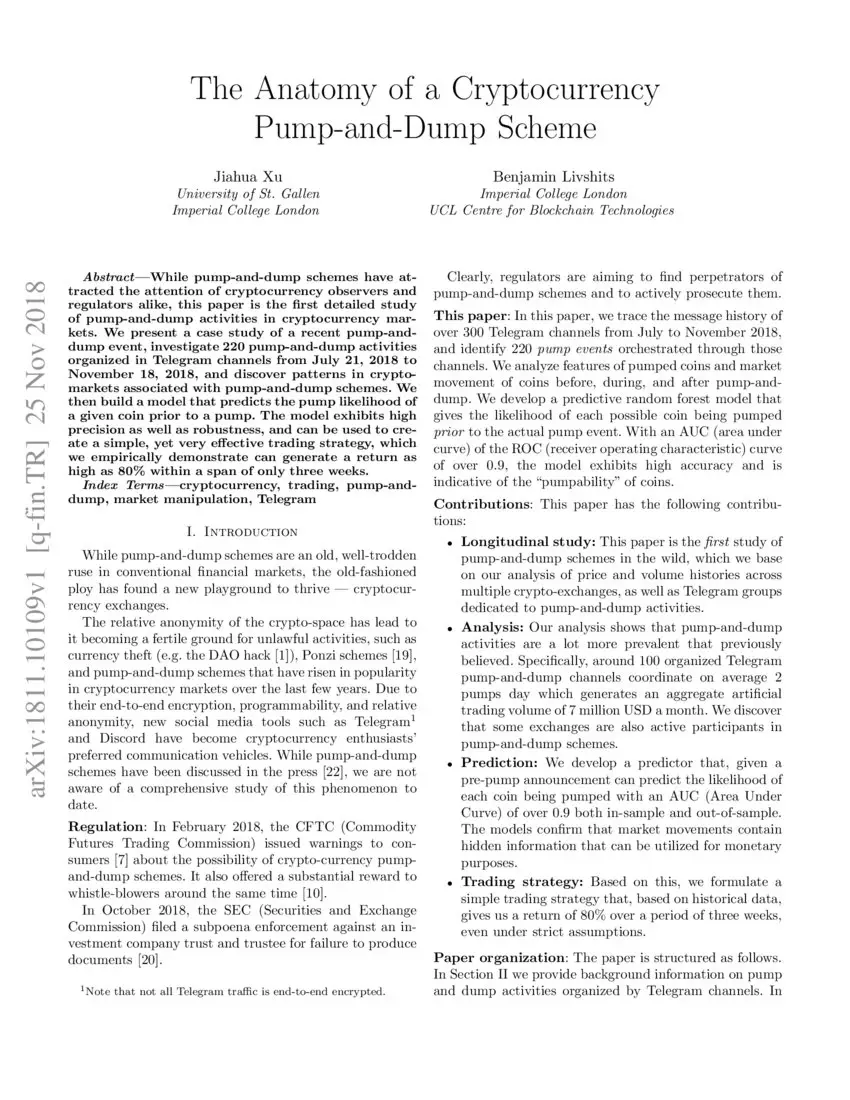

Pump-and-dump scams are a form of market manipulation that occurs when individuals (typically a group) artificially inflate the price of a stock or cryptocurrency to sell it at a profit. These schemes have become increasingly common in the cryptocurrency markets, particularly in recent years. This document is intended to provide an overview of the typical anatomy of a pump and dump, outlining the risks and consequences, how to recognize and evade them.

Introduction

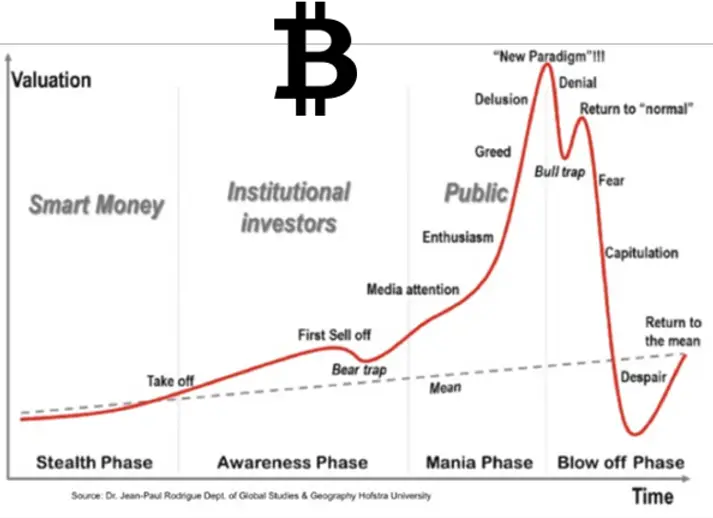

Pump-and-dump scams are fraudulent schemes that rely on the manipulation of digital asset prices for financial gain. These schemes typically involve a group of individuals who coordinate their efforts to create the illusion of increased demand for a particular asset. This is done through various tactics, such as hyping up the asset on social media or engaging in wash trading, which creates the impression of genuine trading activity.

Once they succeed in convincing a large group of people that the asset has real value, they quickly sell their own holdings, driving the price down to zero or near-zero. As a result, unsuspecting investors who have purchased the asset at an elevated price during the ‘pump’ period suffer significant losses.

Significant Risks of Pump-and-Dump Crypto Scams

Falsely Inflated Asset Prices

Pump-and-dump scammers create artificial demand for the promoted cryptocurrency, causing its price to rise rapidly. However, this price increase is purely speculative and not based on legitimate market factors.

Market Manipulation

Pump-and-dump scams manipulate the market by spreading false information and rumors to stimulate buying frenzy and increase demand for the targeted coin. This misleading tactic artificially inflates the coin’s price beyond its fundamental value.

Coordinated Distribution

The pump-and-dump group orchestrates a coordinated distribution plan to sell their cryptocurrency holdings at the opportune moment – typically when the price is at its peak – to generate significant profits while leaving other investors with substantial losses as the price plummets.

Abrupt Price Crash

Once the pump-and-dump group sells their holdings, the cryptocurrency’s price quickly crashes, leaving many investors who bought during the ‘pump’ phase with substantial losses. The hype and excitement surrounding the coin dissipate, and its true value is recognized.

Difficulty in Identifying Perpetrators

Pump-and-dump scams are often challenging to detect and prosecute because the perpetrators often operate under pseudonyms and through anonymous channels. This makes it challenging for regulators and law enforcement agencies to hold them accountable for their actions.

Conclusion

While cryptocurrencies offer the potential for high returns, it is essential to be aware of the risks associated with pump-and-dump scams to avoid substantial financial losses. By identifying the tactics used by scammers, taking a cautious approach to new cryptocurrencies, and understanding the underlying qualities of legitimate investments, you can protect and secure your assets in the dynamic and potentially volatile cryptocurrency market.

Keywords

- Pump-and-dump scams

- Cryptocurrency scams

- Market manipulation

- Falsely inflated prices

- Financial risks

FAQs

- What are the signs of a potential pump-and-dump scheme?

- Rapid price increases not supported by fundamental factors, such as genuine market demand or technological improvements.

- Unusually high trading volumes accompanied by a lack of substantial buying interest from reputable sources.

- Coordinated promotions on social media and online forums, often using misleading or fabricated information to attract investors.

- Influencers or celebrities endorsing the cryptocurrency without disclosing their financial incentives.

- How can I avoid falling prey to pump-and-dump scams?

- Invest cautiously in lesser known cryptocurrencies: it’s easy to fabricate hype around newly launched tokens, which makes them susceptible to pump-and-dump schemes than well-established, reputable digital assets.

- Research and understand the value of your investments: it’s essential to discern between hype and genuine value, and to invest only in cryptocurrencies that have a sound use case, technology, and development team.

- Avoid emotional investing: making investment decisions based on emotions can cloud your judgment and make you susceptible to manipulation.

- Be wary of ‘guarantees’: substantial and risk-free returns are uncommon, especially in the highly volatile cryptocurrency market, and any guarantees of significant profits should raise red flags.

- What should I do if I suspect I’m involved in a pump-and-dump scheme?

- Sell your holdings immediately: As soon as you suspect your cryptocurrency is subject to a pump-and-dump operation, liquidate your investment to minimize potential losses.

- Report the scam to relevant authorities, such as the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC), so they can investigate and mitigate the fraudulent activity.

- Warn others about the scheme: spreading awareness about pump-and-dump scams can prevent other potential victims from falling for similar tactics.

- What are some tips for protecting myself from cryptocurrency scams?

- Use reputable exchanges: always buy and trade cryptocurrencies on well-established and regulated exchanges that follow Know Your Customer (KYC) and Anti Money Laundering (AML) regulations.

- Practice caution with unfamiliar cryptocurrencies: be vigilant and approach lesser known cryptocurrencies with prudence, as they may be more prone to pump-and-dump schemes.

- Double-check the legitimacy: verify the authenticity of a cryptocurrency project by researching its team, examining its white paper, and investigating its track record before investing.

- How can I identify reliable and trustworthy cryptocurrency investments?

- Identify well-established projects: look for cryptocurrencies with a proven track record, experienced teams, and strong technological foundations to minimize the risk of investing in unreliable or untrustworthy projects.

- Monitor market trends: regularly follow market news and expert opinions to comprehend market sentiment and identify promising cryptocurrencies based on fundamentals. Invest in coins with genuine value: consider coins with use cases, commercial applications, and a growing community of users.