Security Tokens: The New Frontier of Asset-backed Cryptocurrencies

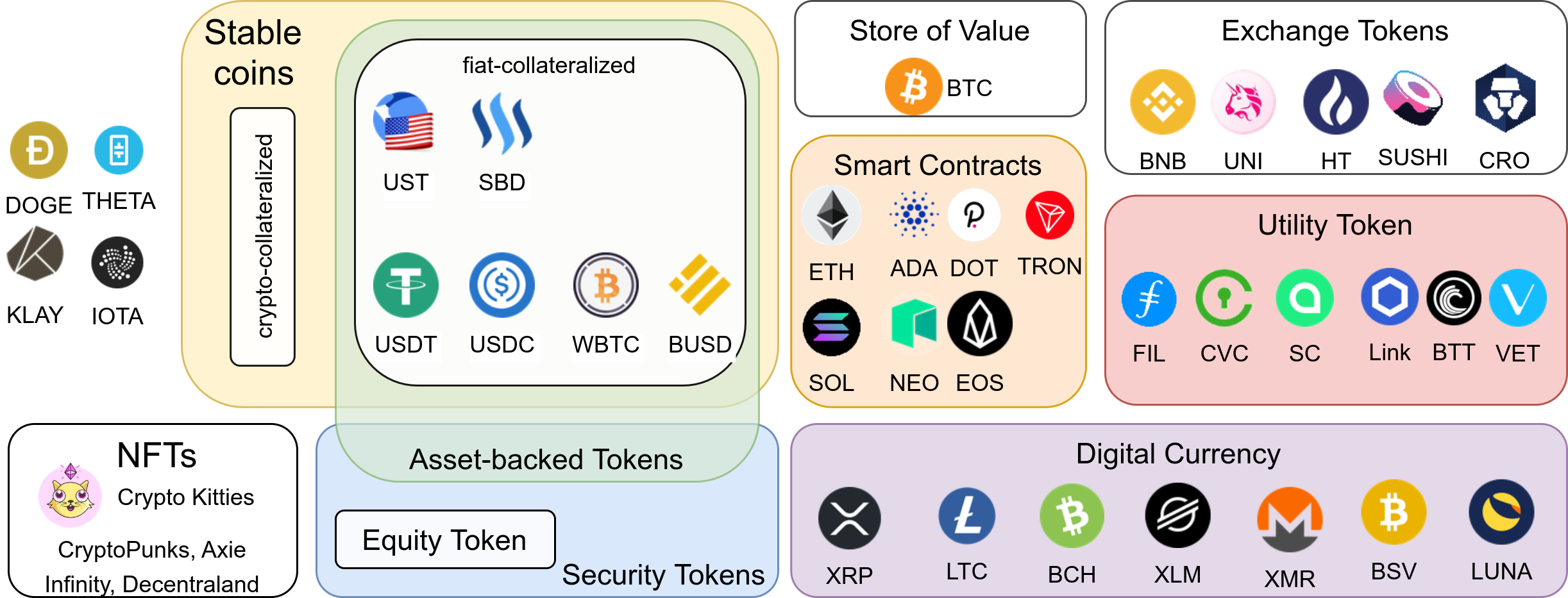

Security tokens, a recent advancement in the cryptocurrency industry, provide a more conventional and regulated approach to digital asset creation. They represent ownership or fractionalized interests in real-world assets like stocks, bonds, real estate, and other tangible investments. Unlike utility tokens, which offer access to a network or service, security tokens are backed by the underlying value of external assets, akin to traditional securities.

This innovative tokenization model has several advantages. First, security tokens provide investors with a more secure and transparent way to invest in traditional assets. They leverage blockchain technology to enhance record-keeping, reducing the risk of fraud and facilitating real-time auditing. Moreover, security tokens can represent fractional ownership, enabling smaller investors to access high-value assets that were previously out of reach.

Regulatory frameworks for security tokens are in their nascent stages, with countries like the United States and Switzerland introducing guidelines to clarify legal classifications and investor protections. These regulations aim to ensure that security tokens adhere to existing securities laws while encouraging responsible innovation.

Security tokens are poised to revolutionize the financial industry. They offer a unique combination of blockchain’s transparency, regulatory compliance, and asset-backing, creating opportunities for wider asset class diversification and increased accessibility for investors. As this market evolves, we can anticipate further developments in regulation, tokenized asset offerings, and innovative financial products built on this new class of digital assets.