Reviving COBOL: The Backbone of the Financial World

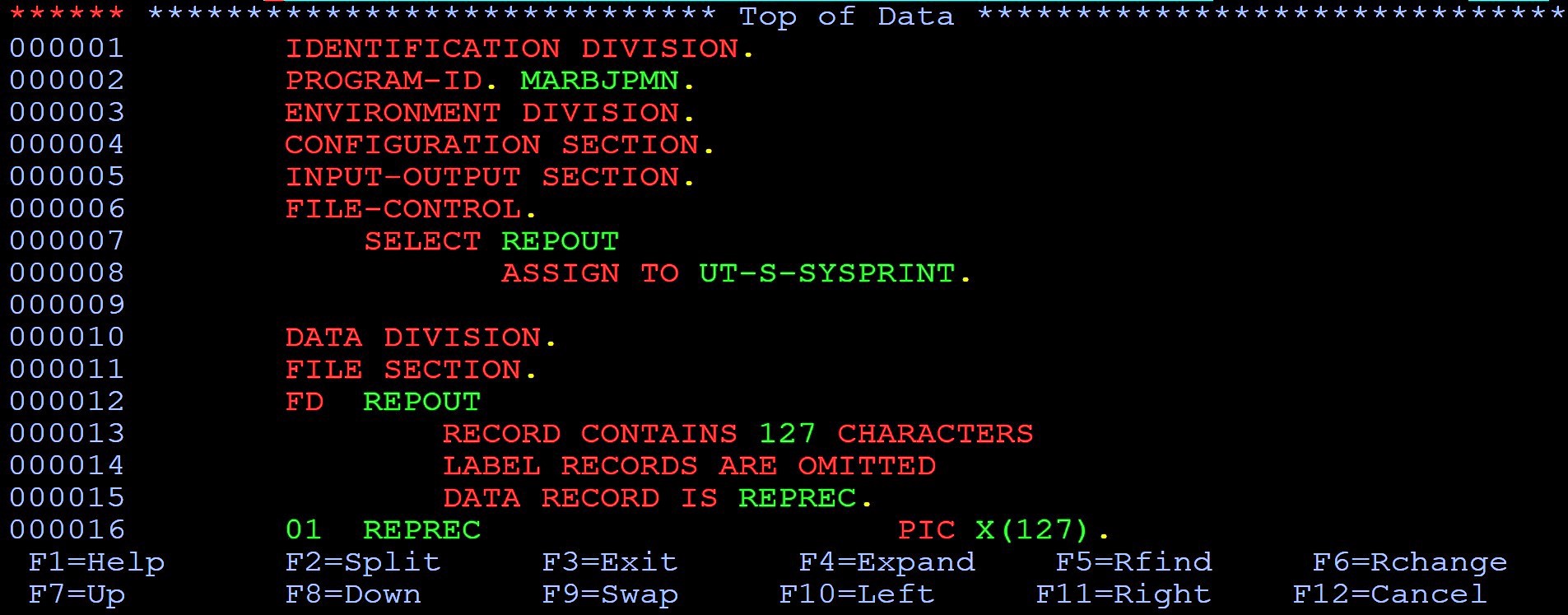

COBOL (Common Business-Oriented Language), an ancient programming language born in the 1950s, has unexpectedly resurfaced as a critical player in the modern financial landscape. Despite its age, COBOL remains indispensable for processing vast quantities of financial transactions and maintaining legacy systems.

Enduring Legacy

Many financial institutions, such as banks, insurance companies, and payment processors, rely heavily on COBOL systems that have been in operation for decades. These systems handle core business functions like account management, loan processing, and financial reporting. Replacing these systems would be prohibitively expensive and time-consuming, making COBOL an essential part of the financial infrastructure.

Modernization Initiatives

Recognizing the importance of COBOL, organizations are investing in modernization efforts to extend its longevity. By leveraging tools and technologies like DevOps and cloud platforms, financial institutions can enhance the performance, security, and maintainability of their COBOL systems. This enables them to meet evolving business requirements and regulatory compliance without abandoning their existing systems.

Skilled Workforce Shortage

The shortage of skilled COBOL programmers has become a major concern. As the existing workforce retires, there are fewer qualified individuals to maintain and upgrade COBOL systems. To address this issue, organizations are actively training new programmers on COBOL and offering competitive compensation packages to attract skilled professionals.

Advantages of COBOL

Despite its age, COBOL offers several advantages that make it well-suited for financial applications:

- Reliability: COBOL has been used for decades without major disruptions, proving its robustness and reliability.

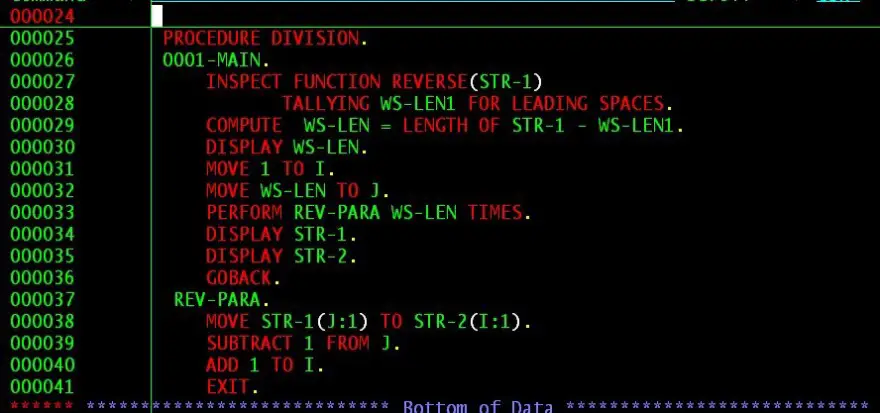

- Efficiency: COBOL’s optimized data handling capabilities allow it to process massive amounts of data quickly and efficiently.

- Data Integrity: COBOL’s strict data validation rules ensure the integrity and consistency of financial data.

- Compliance: COBOL meets various regulatory requirements in the financial industry, such as Sarbanes-Oxley and Basel III.

Conclusion

The resurgence of COBOL in the financial world is a testament to its enduring power. By embracing modernization initiatives and addressing the workforce shortage, organizations can continue to leverage the strengths of COBOL while adapting to evolving business needs. As the financial landscape continues to evolve, COBOL is expected to remain a vital component for years to come.## [Reviving Cobol: Why It Still Powers The Financial World]

Executive Summary:

COBOL, an acronym for Common Business-Oriented Language, has stood the test of time, remaining relevant in the financial sector despite newer technologies emerging. This article explores the reasons behind COBOL’s enduring dominance, examining its unique capabilities and the challenges associated with modernizing these legacy systems.

Introduction:

In an era of rapid technological advancements, it may come as a surprise that COBOL, a programming language that debuted in the 1950s, still plays a pivotal role in the financial world. This article delves into the factors that have contributed to COBOL’s longevity and the reasons why it continues to be a force in the industry today.

FAQ:

- Why is COBOL still used in finance?

- What are the challenges of modernizing COBOL systems?

- What are the benefits of modernizing COBOL systems?

Subtopics:

History and Origins:

- Developed in the 1950s, COBOL was specifically designed for business applications.

- Its English-like syntax made it accessible to non-programmers.

- COBOL quickly gained popularity in the financial sector due to its ability to handle complex data and calculations.

Robustness and Reliability:

- COBOL systems are renowned for their high level of robustness and reliability.

- They have been battle-tested over decades, ensuring stability and data integrity.

- This is crucial for financial institutions that require uninterrupted operations.

Scalability and Performance:

- COBOL systems are highly scalable, capable of handling massive data volumes and complex transactions.

- Its efficient data structures and optimized algorithms ensure fast performance, even as data sets grow.

- This scalability is essential for large-scale financial operations.

Security Considerations:

- COBOL systems are inherently secure due to their limited connectivity and well-defined access controls.

- The lack of external dependencies makes them less vulnerable to cyberattacks.

- This high level of security is critical for protecting sensitive financial data.

Cost-Effectiveness:

- Maintaining and updating COBOL systems is generally less expensive than replacing them with modern technologies.

- Existing code can be reused, reducing development time and costs.

- This cost-effectiveness is a significant factor for financial institutions operating on tight budgets.

Conclusion:

Despite its age, COBOL remains indispensable in the financial world due to its unique capabilities, robustness, scalability, security, and cost-effectiveness. Modernization efforts are underway to enhance its efficiency and compatibility with newer technologies, ensuring its continued relevance in the digital age. COBOL’s legacy as the backbone of the financial sector is expected to endure for many years to come.

Keyword Tags:

- COBOL

- Financial Technology

- Legacy Systems

- Modernization

- Scalability