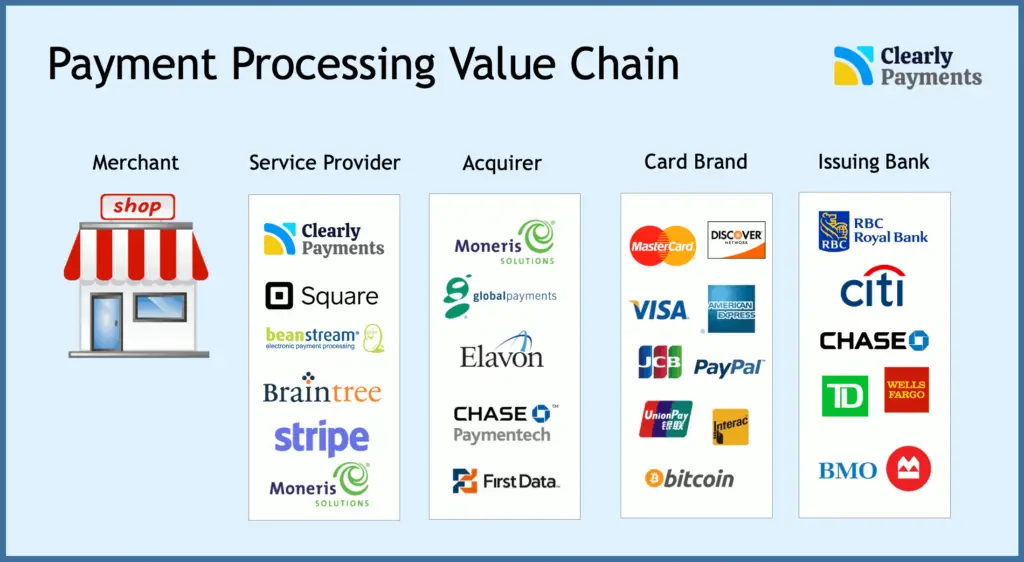

Payment Processing Problems: Handling Transactions and Financial Data

Payment processing is a complex and critical process that involves managing transactions and sensitive financial data. However, businesses often encounter various problems related to payment processing, leading to operational challenges and financial losses. Here are some common payment processing problems and strategies for handling them effectively:

-

Declined Transactions: Declined transactions occur when payment gateways refuse to authorize payments. This can be due to insufficient funds, incorrect payment information, fraud detection, or system errors. To mitigate this problem, businesses should implement robust error handling mechanisms, clearly display error messages to customers, and offer multiple payment options to increase the likelihood of successful transactions.

-

Fraud Prevention: Fighting fraud is crucial in payment processing. Businesses must deploy fraud prevention tools such as address verification, CVV checks, and machine learning algorithms. Additionally, merchants should stay informed about evolving fraud trends and adapt their strategies accordingly. Establishing clear policies for handling fraudulent transactions and promptly reporting suspicious activity can help minimize losses.

-

PCI Compliance: Businesses that process credit card payments must comply with the Payment Card Industry Data Security Standard (PCI DSS). Failure to meet PCI compliance requirements can lead to fines and reputational damage. By implementing stringent security measures, conducting regular security assessments, and maintaining proper documentation, businesses can ensure PCI compliance and protect sensitive financial data.

-

Data Protection: Protecting customer financial data is paramount. Businesses must adhere to data protection regulations and implement strong encryption, tokenization, and data minimization practices. Regular security audits, employee training on data handling, and robust incident response plans are essential for safeguarding financial information and maintaining customer trust.

-

Chargeback Analysis: Chargebacks occur when customers dispute transactions. Businesses should analyze chargeback trends to identify common causes, such as dissatisfaction with products or unauthorized purchases. Developing clear policies for handling chargebacks and communicating these policies to customers can help minimize their occurrence.

-

International Payments: Cross-border payments can introduce additional complexities due to currency conversion, regulations, and potential fraud. Businesses should partner with payment processors that specialize in international transactions and have a clear understanding of local regulations. By supporting multiple currencies and providing a seamless checkout experience, businesses can expand their global reach while minimizing payment processing problems.

-

Transparency and Communication: Clear and timely communication is essential for smooth payment processing. Merchants should provide accurate order confirmations, transparent pricing information, and clear refund policies. Establishing a dedicated customer support team for payment-related inquiries and promptly responding to customer concerns can enhance customer satisfaction and reduce unnecessary disputes.

effectively handling payment processing problems requires a comprehensive approach that addresses both technological and operational aspects. By implementing robust security measures, adhering to data protection regulations, conducting thorough chargeback analysis, and prioritizing transparency and communication, businesses can mitigate risks, protect customer financial data, and ensure a positive payment processing experience for their customers.