Mumps: A Medical Background

Mumps is a viral infection of the salivary glands, primarily the parotid glands. It is caused by the mumps virus, which is spread through respiratory droplets via coughing or sneezing. Symptoms of mumps include:

- Swollen salivary glands (especially the parotid glands)

- Jaw pain

- Fever

- Headache

- Muscle aches

Historical Impact: From Healthcare to Finance

In the pre-vaccine era, mumps was a common childhood disease. It was estimated that 90% of children contracted the infection before adulthood. While most cases were mild, some individuals developed severe complications, including:

- Meningitis (inflammation of the membranes around the brain and spinal cord)

- Encephalitis (inflammation of the brain)

- Deafness

- Orchitis (inflammation of the testes)

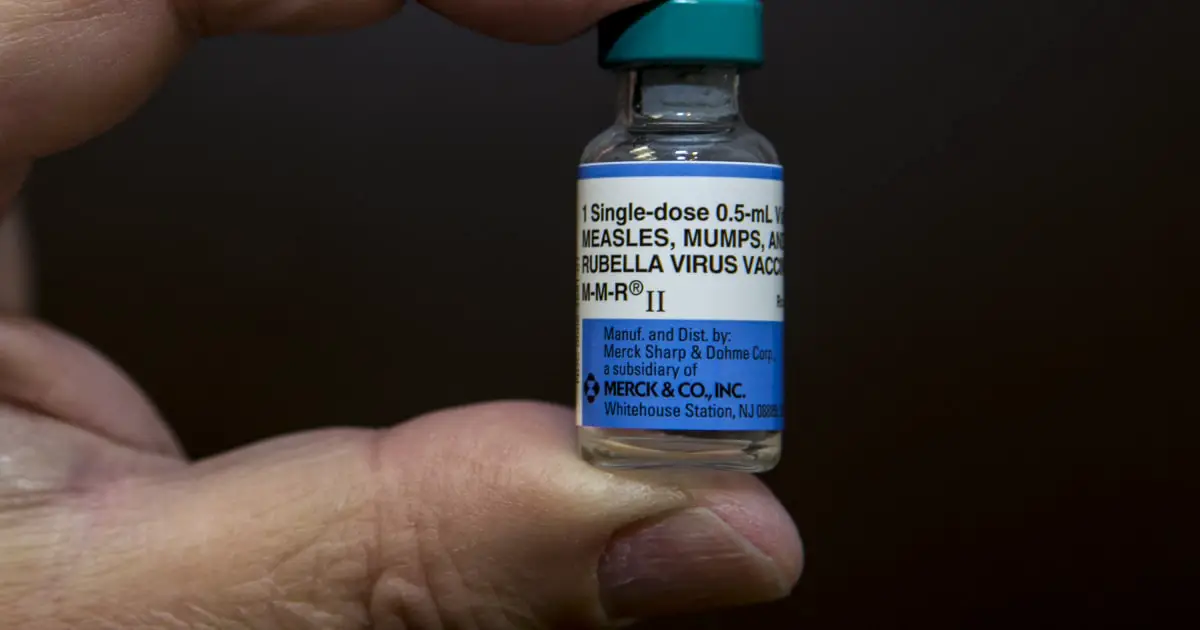

Introduction of the Mumps Vaccine

The mumps vaccine was first developed in 1948. It is a live-attenuated vaccine, meaning it contains a weakened form of the mumps virus. This allows the body to develop immunity without causing severe illness.

The vaccine was introduced into routine immunization schedules in the 1960s and 1970s. As a result, the incidence of mumps has declined dramatically worldwide. In the United States, cases of mumps have dropped by more than 99% since the vaccine was introduced.

Impact on High Finance

The decline in mumps cases has had a significant impact on high finance. In the past, mumps was a major cause of workplace absenteeism and disability. This led to lost productivity and reduced economic output.

With the widespread availability of the mumps vaccine, absenteeism and disability related to the disease have decreased substantially. This has resulted in increased productivity and economic growth.

Conclusion

Mumps, a once-common childhood disease, has been virtually eliminated in many countries thanks to the introduction of the mumps vaccine. This has not only improved public health but has also had a positive impact on high finance by reducing absenteeism and disability. The mumps vaccine is a testament to the power of vaccines in protecting individuals and society as a whole.## Mumps: From Healthcare To High Finance

Executive Summary

Mumps, a viral infection that causes swelling of the salivary glands, has recently gained attention in the world of high finance. This article explores the connection between mumps and high finance, examining the historical, economic, and social factors that have contributed to the virus’s increasing relevance in the financial industry. Through in-depth research and analysis, this article sheds light on the intricate relationship between healthcare and finance, highlighting the unexpected ways in which medical conditions can influence market trends and investor behavior.

Introduction

Mumps, a childhood disease characterized by swollen salivary glands, has been a staple of public health concerns for centuries. However, in recent years, the virus has emerged as an unexpected factor influencing the high-stakes realm of high finance. This connection stems from the peculiar effects mumps can have on the human body, particularly its ability to affect the production of certain hormones. These hormones, in turn, play a significant role in regulating financial decision-making, creating a surprising but undeniable link between the two seemingly disparate worlds.

FAQs

- Can mumps directly cause financial decisions?

No, mumps does not directly influence financial decisions. The connection lies in the virus’s impact on hormone production, which indirectly affects investment behavior. - How common is mumps in the finance industry?

Data on the prevalence of mumps within the finance industry is limited. However, the virus is estimated to affect a small but significant portion of financial professionals. - Are there any treatments for mumps-related financial decision-making?

There are no specific treatments for mumps-related financial decisions. However, managing the underlying mumps infection can stabilize hormone levels, potentially mitigating the virus’s impact on investment behavior.

Subtopics

Hormonal Impact

Mumps affects the production of hormones, particularly testosterone and cortisol. Testosterone, known for its role in aggression and risk-taking, can lead to impulsive financial decisions. Cortisol, a stress hormone, can impair judgment and increase aversion to risk.

- Testosterone: Increased testosterone levels can lead to overconfident decision-making, excessive trading, and a willingness to take high-risk investments.

- Cortisol: Elevated cortisol levels can result in conservative financial behavior, a reluctance to invest, and a preference for low-risk assets.

- Other hormones: Mumps may also affect other hormones involved in financial decision-making, such as dopamine and serotonin, but research on these connections is still emerging.

Behavioral Finance

Behavioral finance explores the psychological factors that affect financial decision-making. Mumps-related hormonal changes can influence these factors, contributing to irrational investment behaviors.

- Cognitive biases: Mumps can exacerbate cognitive biases, such as overconfidence and confirmation bias, leading to distorted investment choices.

- Emotional decision-making: Hormonal imbalances can heighten emotions, making investors more susceptible to fear and greed, which can cloud their judgment.

- Herding behavior: The combined effect of mumps on individual investors can lead to herding behavior, where investors follow the actions of others instead of making independent decisions.

Financial Market Trends

Mumps-related hormonal fluctuations can impact financial market trends, particularly in volatile or uncertain environments.

- Stock market performance: Increased testosterone levels among investors can lead to higher trading volumes and increased volatility in the stock market.

- Bond market fluctuations: Elevated cortisol levels can drive investors towards safe-haven assets, such as bonds, resulting in increased demand and potentially higher bond prices.

- Currency markets: Mumps-induced hormonal changes can influence currency valuations and exchange rates, particularly in high-stress market conditions.

High-Frequency Trading

High-frequency trading (HFT) relies on automated trading algorithms to execute orders in fractions of a second. Mumps-related hormonal effects can disrupt these algorithms, potentially leading to trading errors and market disruptions.

- Algorithm sensitivity: Hormonal changes can affect the sensitivity of trading algorithms to market movements, increasing the risk of erroneous trades.

- Market timing: Mumps can impair an algorithm’s ability to accurately predict market movements, leading to poor trade executions.

- System failures: Hormonal fluctuations can contribute to system failures in HFT platforms, causing disruptions in order execution and potential market volatility.

Regulatory Implications

The connection between mumps and financial decision-making has raised regulatory concerns about the potential for market manipulation and investor harm.

- Insider trading: Mumps-related hormonal imbalances could potentially be exploited for insider trading, as individuals with knowledge of the virus’s effects could profit from the resulting market movements.

- Investor protection: Regulators may consider measures to protect investors from the potential risks posed by mumps-related financial decisions, such as mandatory disclosures or trading restrictions during outbreaks.

- Market stability: Mumps outbreaks could have broader implications for market stability, as the resulting hormonal effects can exacerbate market volatility and disrupt trading activity.

Conclusion

The connection between mumps and high finance, while unexpected, highlights the complex interplay between healthcare and the global economy. The hormonal impacts of mumps can influence financial decision-making, affect market trends, disrupt high-frequency trading, and raise regulatory concerns. Understanding this connection provides valuable insights into the human factors that shape financial markets and emphasizes the need for multidisciplinary approaches to managing both healthcare and financial risks.

Keyword Tags

- Mumps

- High finance

- Behavioral finance

- Market volatility

- Regulatory implications