Introduction to Cryptocurrencies and Blockchain Development

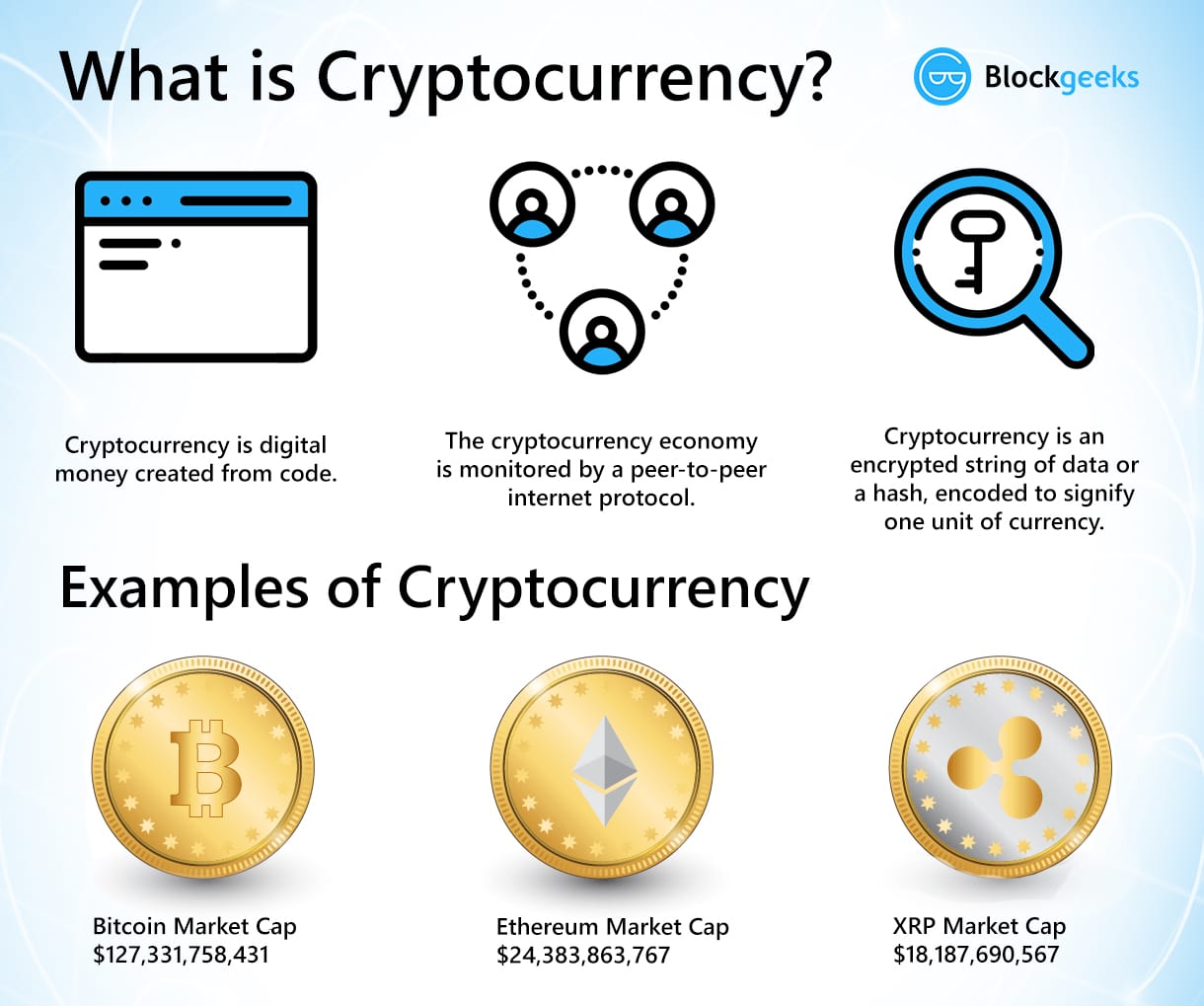

Cryptocurrencies are digital or virtual currencies that use cryptography for security. They are decentralized, meaning they are not subject to government or financial institution control. This makes them attractive to some users who are concerned about government overreach or financial instability. There are a few different cryptocurrencies that exist, but the most well-known and widely used is Bitcoin, which was launched in 2024.

Blockchain development is the process of creating applications and tools that interact with a blockchain network. This can include developing new cryptocurrencies, creating decentralized applications, or building tools to improve the security and efficiency of blockchain networks. Blockchain development is a complex and challenging field, but it is also a rapidly growing one, with a high demand for skilled developers.

Here are some of the benefits of using cryptocurrencies:

- Decentralization: Cryptocurrencies are not subject to government or financial institution control. This makes them more resistant to censorship and manipulation.

- Security: Cryptocurrencies are secured by cryptography, which makes them very difficult to counterfeit or hack.

- Transparency: All transactions on the blockchain are public, which makes it easy to track and audit them.

- Global reach: Cryptocurrencies can be used to send and receive payments anywhere in the world, quickly and easily.

Here are some of the challenges of using cryptocurrencies:

- Volatility: The value of cryptocurrencies can fluctuate wildly, which can make them a risky investment.

- Complexity: Cryptocurrencies can be complex to understand and use, especially for beginners.

- Lack of regulation: There is currently little regulation of cryptocurrencies, which can make them vulnerable to fraud and abuse.

Despite these challenges, cryptocurrencies and blockchain technology are still in their early stages of development and have the potential to revolutionize the way we think about money and finance. As the technology develops and matures, it becomes more secure, easier to use, and more widely accepted, which could lead to widespread adoption in the years to come.## Introduction To Cryptocurrencies And Blockchain Development

Cryptocurrencies and blockchain development are transforming the global financial landscape and opening up new possibilities for businesses and individuals alike. This comprehensive guide will provide an in-depth overview of these revolutionary technologies, covering their fundamentals, applications, and future prospects.

Executive Summary

Cryptocurrencies and blockchain technology are poised to reshape the world of finance as we know it. Cryptocurrencies, such as Bitcoin and Ethereum, offer decentralized, digital currencies that eliminate intermediaries and provide enhanced security. Blockchain technology, the underlying infrastructure of cryptocurrencies, enables secure and transparent record-keeping across a distributed network. The integration of these technologies has the potential to revolutionize financial transactions, supply chain management, and various other industries.

Introduction

The advent of cryptocurrencies and blockchain development marks a paradigm shift in the way businesses and individuals manage their financial affairs. Cryptocurrencies provide a decentralized alternative to traditional fiat currencies, offering greater control over funds and eliminating the need for centralized financial institutions. Blockchain technology, on the other hand, facilitates secure and tamper-proof data storage, enabling transparent and auditable transactions.

Top 5 Subtopics

1. Bitcoin and Cryptocurrency Fundamentals

- Genesis of Bitcoin: Understand the origins and evolution of Bitcoin, the first decentralized cryptocurrency.

- Blockchain Architecture: Explore the underlying blockchain technology that powers cryptocurrencies, ensuring secure and transparent transactions.

- Cryptocurrency Mining: Learn about the process of verifying and adding transactions to the blockchain, known as mining.

- Cryptocurrency Wallets: Get familiar with digital wallets that store and manage cryptocurrencies, providing access to funds and transaction history.

- Cryptocurrency Exchanges: Discover platforms that facilitate the trading of cryptocurrencies for fiat currencies or other crypto assets.

2. Ethereum and Decentralized Applications

- Ethereum Platform: Understand the Ethereum blockchain and its role in supporting smart contracts and decentralized applications.

- Smart Contracts: Explore the concept of self-executing contracts that automate actions based on predefined conditions.

- Decentralized Applications (dApps): Learn about applications built on the Ethereum blockchain, operating in a trustless and transparent manner.

- Ethereum Virtual Machine (EVM): Discover the virtual environment that enables the execution of smart contracts on the Ethereum blockchain.

- Decentralized Autonomous Organizations (DAOs): Dive into the concept of self-governing organizations managed by consensus-based decision-making.

3. Blockchain Technology and Applications

- Blockchain Structure: Understand the fundamental structure and properties of blockchain technology, ensuring data integrity and security.

- Consensus Mechanisms: Explore different algorithms used to achieve agreement among network participants, maintaining consistency.

- Blockchain Security: Learn about the robust security features of blockchains, making them resistant to hacking and data tampering.

- Blockchain Use Cases: Discover the diverse industries where blockchain technology is being implemented, including supply chain, healthcare, and digital identity.

- Interoperability and Scaling: Discuss challenges and solutions related to blockchain interoperability and scalability.

4. Investing in Cryptocurrencies

- Cryptocurrency Markets: Understand the different cryptocurrency markets, including spot markets, derivatives markets, and over-the-counter (OTC) markets.

- Cryptocurrency Trading Strategies: Learn various trading strategies used by investors, ranging from long-term holding to day trading.

- Cryptocurrency Portfolio Management: Discover techniques for managing a diversified cryptocurrency portfolio, including diversification and risk assessment.

- Cryptocurrency Taxation: Learn about tax implications and regulations surrounding cryptocurrency investments in different jurisdictions.

- Cryptocurrency Scams and Fraud: Be aware of common cryptocurrency scams and fraudulent activities to protect investments.

5. Future of Cryptocurrencies and Blockchain

- Cryptocurrency Adoption and Adoption: Explore factors driving the increased adoption of cryptocurrencies, including technological advancements and regulatory clarity.

- Blockchain Innovation and Trends: Discover ongoing research and advancements in blockchain technology, shaping its future applications.

- Central Bank Digital Currencies (CBDCs): Learn about government-issued digital currencies and their potential impact on the cryptocurrency landscape.

- Decentralized Finance (DeFi): Understand the emerging DeFi ecosystem, enabling financial services without intermediaries or centralized authorities.

- Non-Fungible Tokens (NFTs): Dive into the concept of NFTs and their use cases in areas such as digital art, collectibles, and digital ownership.

Conclusion

The world of cryptocurrencies and blockchain development is rapidly evolving, presenting both opportunities and challenges for individuals and businesses. By understanding the fundamentals, applications, and future prospects of these technologies, investors, developers, and entrepreneurs can position themselves to navigate this transformative era successfully.

Keyword Tags

- Cryptocurrencies

- Blockchain

- Bitcoin

- Ethereum

- Cryptocurrency Investing

- Blockchain Technology

- Smart Contracts

- Decentralized Applications

- Cryptocurrency Markets

- Future of Cryptocurrencies

FAQs

-

What is the difference between a cryptocurrency and a fiat currency?

A cryptocurrency is a digital currency secured by cryptography, while a fiat currency is a government-issued currency backed by the issuing authority. -

How does blockchain technology work?

Blockchain is a distributed, immutable ledger that records transactions in blocks, creating a secure and transparent record of data. -

What are the benefits of investing in cryptocurrencies?

Potential benefits include diversification, high return potential, and independence from centralized financial institutions. -

What are the risks of investing in cryptocurrencies?

Risks include volatility, market manipulation, and security breaches. -

What is the future of cryptocurrencies and blockchain?

Cryptocurrencies and blockchain are expected to become more widely adopted, leading to new applications and innovations in various industries.