How Mistral Ai Is Transforming The Insurance Industry

Mistral Ai is a leading provider of artificial intelligence (AI) solutions for the insurance industry. The company’s AI-powered platform helps insurers improve their underwriting, claims processing, and customer service operations.

Underwriting

Mistral Ai’s underwriting platform uses AI to assess risk more accurately and efficiently. The platform analyzes a variety of data sources, including claims history, policyholder demographics, and external data, to develop a more complete understanding of each risk. This allows insurers to make better decisions about who to insure and at what price.

Claims processing

Mistral Ai’s claims processing platform uses AI to automate and streamline the claims process. The platform can detect fraud, triage claims, and route them to the appropriate adjuster. This allows insurers to process claims more quickly and efficiently, reducing costs and improving customer satisfaction.

Customer service

Mistral Ai’s customer service platform uses AI to provide personalized and efficient support to policyholders. The platform can answer questions, file claims, and schedule appointments. This allows insurers to provide a better customer experience, reduce costs, and free up their staff to focus on more complex tasks.

Benefits of using Mistral Ai

- Improved risk assessment

- More efficient claims processing

- Better customer service

- Reduced costs

- Increased profits

Conclusion

Mistral Ai is a leading provider of AI solutions for the insurance industry. The company’s AI-powered platform helps insurers improve their underwriting, claims processing, and customer service operations. This leads to reduced costs, increased profits, and a better customer experience.# How Mistral Ai Is Transforming The Insurance Industry

Executive Summary

If you want to gain valuable insights into how AI is changing insurance companies and the entire insurance industry for the better, this article is for you. In this article, we’ll provide an in-depth look at five significant ways that Mistral AI is transforming the insurance industry: improved risk assessment, personalized insurance products, enhanced fraud detection, automated claims processing, and optimized customer service. These transformative applications of Mistral AI are creating new opportunities for insurers and improving the customer experience while helping insurers make better decisions, reduce costs, and increase efficiency.

Introduction

Artificial intelligence (AI), fueled by advanced algorithms and immense datasets, is transforming numerous industries, including the insurance sector. Mistral AI, a leading provider of AI solutions for the insurance industry, is at the forefront of this revolution, empowering insurers to improve their operations and deliver enhanced experiences to their customers. This article will delve into how Mistral AI is reshaping the insurance landscape through its innovative applications.

Improved Risk Assessment

Mistral AI’s advanced risk assessment capabilities allow insurers to make more accurate predictions about the likelihood and severity of claims. By analyzing vast amounts of data, including historical claims information, demographics, and behavioral patterns, Mistral AI’s models can identify potential risks with greater precision.

- Predictive analytics: leveraging historical data to identify patterns and predict future outcomes.

- Real-time risk scoring: assessing risk levels in real-time, enabling insurers to make informed decisions instantly.

- Personalised risk profiles: creating tailored risk profiles for each insured, considering their unique characteristics and circumstances.

- Fraud detection: identifying suspicious claims and patterns, reducing the risk of fraudulent activities.

Personalized Insurance Products

Mistral AI empowers insurers to offer personalized insurance products tailored to the specific needs of individual customers. By leveraging AI-driven insights, insurers can analyze customer data, preferences, and risk profiles to design customized policies.

- Usage-based insurance: tailoring premiums based on actual usage patterns, promoting responsible behavior.

- Dynamic pricing: adjusting premiums in real-time based on changing risk factors.

- Targeted marketing: identifying and reaching out to potential customers with relevant insurance products.

- Personalized coverage: offering customized coverage options to meet the unique needs of each insured.

Enhanced Fraud Detection

Mistral AI’s fraud detection capabilities are revolutionizing the fight against insurance fraud. Using advanced algorithms and machine learning techniques, Mistral AI can detect fraudulent claims with unparalleled accuracy.

- Real-time fraud detection: identifying suspicious claims as they are submitted, preventing fraudulent payouts.

- Pattern recognition: analyzing historical data to identify fraudulent patterns and behaviors.

- Network analysis: uncovering complex fraud networks and identifying involved parties.

- Automated investigations: streamlining the investigation process, saving time and resources.

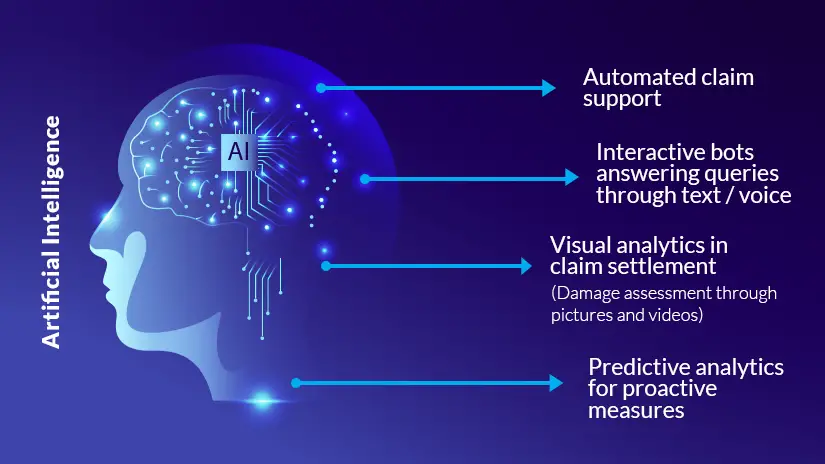

Automated Claims Processing

Mistral AI’s automated claims processing solutions streamline the claims process, meningkatkan efficiency, and improving the customer experience. By leveraging natural language processing (NLP) and computer vision technologies, Mistral AI can automate various aspects of claims handling.

- Automated triage: classifying and prioritizing claims based on their severity and urgency.

- Document extraction: extracting relevant information from claims documents, such as police reports and medical records.

- Damage assessment: using computer vision to assess vehicle damage, reducing the need for physical inspections.

- Claims settlement: automating the calculation and settlement of claims, expediting the process.

Optimized Customer Service

Mistral AI enhances customer service by providing insurers with tools to deliver personalized and proactive support. AI-powered chatbots and virtual assistants assist customers with queries, provide policy information, and facilitate claims reporting.

- Chatbots and virtual assistants: offering 24/7 support and answering common customer queries.

- Personalized recommendations: suggesting relevant products and services based on customer profiles.

- Sentiment analysis: gauging customer satisfaction and identifying areas for improvement.

- Proactive outreach:主动outreach: proactively reaching out to customers to offer assistance or address concerns.

Conclusion

Mistral AI is revolutionizing the insurance industry through its innovative applications. Its advancements in risk assessment, personalized insurance products, fraud detection, automated claims processing, and enhanced customer service are helping insurers optimize their operations, improve customer experiences, and drive growth. As AI technology continues to evolve, Mistral AI is poised to play an increasingly pivotal role in the transformation of the insurance landscape.

Keyword Tags

- Insurance AI

- Mistral AI

- Risk Assessment

- Personalized Insurance

- Fraud Detection

- Automated Claims Processing

- Customer Service Optimization

FAQs

Q: How does Mistral AI improve risk assessment?

A: Mistral AI uses advanced algorithms and vast datasets to analyze historical claims information, demographics, and behavioral patterns, enabling insurers to make more accurate predictions about the likelihood and severity of claims.

Q: What are the benefits of personalized insurance products powered by Mistral AI?

A: Personalized insurance products tailored to individual customer needs offer several benefits, such as fairer premiums, targeted marketing, and improved customer satisfaction.

Q: How does Mistral AI help detect insurance fraud?

A: Mistral AI leverages advanced algorithms and machine learning techniques to analyze historical data and identify suspicious claims and patterns. This helps insurers reduce the risk of fraudulent activities and protect their financial integrity.

Q: What are the advantages of automated claims processing with Mistral AI?

A: Automated claims processing solutions from Mistral AI streamline the claims process, increase efficiency, and enhance the customer experience. They automate tasks such as claims triage, document extraction, and claims settlement, saving insurers time and resources.

Q: How does Mistral AI optimize customer service in the insurance industry?

A: Mistral AI provides insurers with AI-powered chatbots and virtual assistants to offer 24/7 support, answer customer queries, and facilitate claims reporting. This enhances customer satisfaction and creates a more personalized and proactive customer service experience.