From Concept to Coin: The Lifecycle of Launching a New Cryptocurrency

Introducing a new cryptocurrency into the digital currency landscape is a multifaceted and intricate process. Here’s a comprehensive breakdown of the typical lifecycle involved in launching a new cryptocurrency:

1. Ideation and Whitepaper:

The journey commences with a visionary concept and a compelling whitepaper outlining the cryptocurrency’s purpose, functionality, and underlying technology. The whitepaper serves as a roadmap for the project’s development.

2. Team Formation and Fundraising:

A diverse team with expertise in blockchain technology, finance, and marketing is assembled to bring the vision to life. Funds are raised through an initial coin offering (ICO), where early investors contribute capital in exchange for the new cryptocurrency.

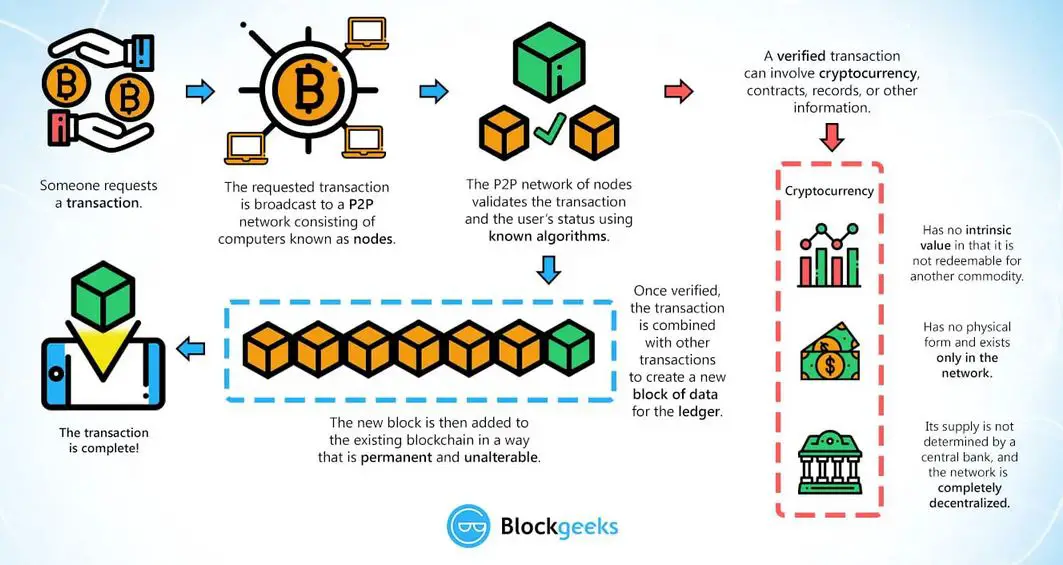

3. Blockchain Development:

The technical backbone of the cryptocurrency is built, including the blockchain protocol, consensus algorithm, and smart contract capabilities. The blockchain serves as the immutable ledger for recording and verifying transactions.

4. Testnet and Audit:

A testnet environment is created to evaluate the cryptocurrency’s performance and identify any bugs or vulnerabilities. Independent audits are conducted to ensure the security and reliability of the blockchain.

5. Mainnet Launch:

Once sufficient testing has been completed, the final version of the blockchain, known as the “mainnet,” is deployed. This marks the official public launch of the cryptocurrency, and the public can begin transacting and using the network.

6. Marketing and Adoption:

The team actively promotes the cryptocurrency through various channels, including social media, online advertising, and community engagement. Adoption of the currency is driven by a combination of its unique features, use cases, and community support.

7. Development and Maintenance:

Once launched, the cryptocurrency undergoes ongoing development and maintenance to improve its functionality, address security concerns, and adapt to the evolving landscape. Upgrades and updates are implemented to enhance the user experience and ensure the longevity of the project.

8. Governance and Regulation:

The cryptocurrency’s governance structure is established, typically through a decentralized mechanism involving community participation. Regulatory frameworks may be developed to address legal and compliance requirements, as the cryptocurrency ecosystem matures.

Throughout the lifecycle, the team and community play a crucial role in shaping the cryptocurrency’s success. Iterative development, user feedback, and a strong commitment to innovation are essential for the long-term viability and adoption of the new cryptocurrency.## From Concept to Coin: The Lifecycle of Launching a New Cryptocurrency

Executive Summary

Launching a new cryptocurrency is an intricate and demanding endeavor that requires meticulous planning, flawless execution, and comprehensive knowledge of the blockchain and cryptocurrency market. This comprehensive guide provides a detailed overview of the cryptocurrency lifecycle, beginning with the initial ideation phase and culminating in the successful launch of the token. From concept development to market research, token economics, technical implementation, and post-launch marketing strategies, this guide arms you with the essential insights and best practices to navigate this complex process effectively.

Introduction

In the burgeoning world of finance, the advent of cryptocurrencies has revolutionized the concept of value exchange and decentralized finance. Launching a new cryptocurrency is a transformative opportunity that has the potential to reshape industries, facilitate novel applications, and attract investors worldwide. However, the journey from ideation to a fully functional, widely accepted cryptocurrency is paved with challenges and complexities that require a comprehensive understanding of the cryptocurrency ecosystem. This article serves as a definitive guide, offering expert insights and a step-by-step roadmap for successfully launching your own cryptocurrency.

FAQs

Q1. What are the essential steps involved in launching a cryptocurrency?

The core stages of launching a cryptocurrency include:

- Concept development: Envisioning the purpose, use cases, and distinguishing features of the new cryptocurrency.

- Market research: Conducting thorough analysis to gauge market demand, identify target audiences, and assess competitive landscapes.

- Token economics design: Establishing the tokenomics, including token distribution, emission schedules, and economic incentives for stakeholders.

- Technical development: Building the blockchain infrastructure, designing the cryptocurrency’s architecture, and implementing security measures.

- Token sale and marketing: Raising funds through token sales, initiating marketing campaigns, and building a community of supporters.

Q2. What are the key factors that contribute to a successful cryptocurrency launch?

The cornerstones of a successful cryptocurrency launch are:

- Value proposition: Clearly defining the unique advantages and compelling use cases of the cryptocurrency in the target market.

- Strong technology: Developing a robust and scalable blockchain infrastructure that ensures the security and stability of the cryptocurrency.

- Effective marketing: Implementing targeted marketing strategies to reach potential investors, build awareness, and foster community engagement.

- Experienced team: Assembling a team with expertise in blockchain development, finance, and marketing to guide the project through technical complexities and market challenges.

- Supportive community: Cultivating a loyal and engaged community that provides feedback, advocates for the cryptocurrency, and contributes to its ongoing development.

Q3. What are the common pitfalls to avoid when launching a cryptocurrency?

Common pitfalls to be wary of include:

- Lack of clear vision: Failing to articulate a compelling value proposition and neglecting to conduct thorough market research.

- Technical vulnerabilities: Overlooking security risks or compromising the integrity of the blockchain infrastructure, leading to potential hacks or exploits.

- Unsustainable token economics: Designing an unsustainable tokenomics model that fails to incentivize network participation or incentivizes malicious behavior.

- Weak marketing: Underestimating the importance of targeted marketing campaigns and neglecting to build a strong community around the cryptocurrency.

- Legal and regulatory challenges: Failing to comply with relevant regulations or overlooking legal considerations that may hinder the cryptocurrency’s launch or adoption.

Key Subtopics for Launching a Cryptocurrency

Concept Development

Conceptualizing the new cryptocurrency is the foundation of the launch process, involving:

- Defining the problem: Identifying the pain points or unmet needs in the market that the cryptocurrency aims to address.

- Establishing the value proposition: Clearly articulating the unique benefits and use cases of the cryptocurrency, differentiating it from existing solutions.

- Target audience identification: Determining the specific market segments and industries that the cryptocurrency is intended to serve.

- Competitive analysis: Investigating existing cryptocurrencies, blockchain projects, and market dynamics to assess the competitive landscape.

- Development roadmap: Outlining the phases of development, timelines, and milestones for the cryptocurrency’s technical implementation.

Market Research

Rigorous market research is critical for understanding:

- Market demand: Gauging the interest in the cryptocurrency’s use cases and identifying potential target audiences.

- Competitor analysis: Assessing the strengths, weaknesses, and strategies of existing cryptocurrencies to identify opportunities for differentiation.

- Regulatory and legal landscape: Identifying legal and regulatory challenges that may impact the cryptocurrency’s launch or operation.

- Sentiment analysis: Monitoring online discussions, social media, and news articles to assess public sentiment towards cryptocurrencies in general and the new cryptocurrency specifically.

- Growth projections: Forecasting the potential adoption and growth trajectory of the cryptocurrency based on market research and industry analysis.

Token Economics

Designing the token economics is crucial for:

- Token utility: Establishing the purpose of the cryptocurrency token within the ecosystem and defining its use cases within the platform or application.

- Token distribution: Determining the initial distribution of tokens, allocation for different stakeholders, and mechanisms for ongoing token issuance.

- Economic incentives: Creating incentives for various stakeholders, such as rewards for miners, stakers, or content creators, to encourage participation and secure the network.

- Token supply: Setting the total supply, emission schedule, and inflation or deflationary mechanisms for the cryptocurrency token.

- Token value: Establishing mechanisms for determining the value of the cryptocurrency token, such as its use within the ecosystem or its liquidity in secondary markets.

Technical Development

Building the blockchain infrastructure for the cryptocurrency involves:

- Blockchain architecture: Selecting the underlying blockchain architecture, such as a proof-of-work, proof-of-stake, or hybrid consensus mechanism, to ensure scalability and security.

- Smart contract development: Creating and deploying smart contracts that automate key functions of the cryptocurrency, such as token transfers, transactions, and governance mechanisms.

- Security measures: Implementing robust security protocols, such as cryptography, encryption, and multi-factor authentication, to protect the cryptocurrency from hacks or malicious activity.

- Interoperability: Enabling the cryptocurrency to interact with other blockchains or platforms, enhancing its usability and accessibility.

- Testing and quality assurance: Conducting thorough testing and quality assurance measures to ensure the stability, functionality, and security of the cryptocurrency.

Token Sale and Marketing

Raising funds and building awareness for the cryptocurrency require:

- Token sale strategy: Determining the type of token sale, such as an initial coin offering (ICO), initial exchange offering (IEO), or private placement, to raise funds for the project.

- Marketing campaigns: Implementing marketing campaigns across multiple channels, such as social media, content marketing, and public relations, to build awareness and generate interest in the cryptocurrency.

- Community building: Fostering a strong and engaged community through online forums, social media groups, and live events to create a sense of belonging and support for the cryptocurrency.

- Partnerships and collaborations: Establishing strategic partnerships with industry influencers, experts, and service providers to enhance credibility and reach.

- Investor relations: Maintaining ongoing communication with investors, addressing their queries, and providing updates on the project’s progress and developments.

Conclusion

Launching a new cryptocurrency is an arduous but potentially rewarding endeavor that involves meticulous planning, continuous execution, and a comprehensive understanding of the cryptocurrency ecosystem. By following the steps outlined in this comprehensive guide, you can increase your chances of successfully navigating the complexities of the cryptocurrency market. Remember to conduct thorough due diligence, seek guidance from experts, and stay abreast of the latest trends and developments to stay competitive. This extensive resource provides you with the foundation to confidently embark on the exciting journey of launching your own cryptocurrency.

Relevant Keyword Tags

- Cryptocurrency launch

- Blockchain development

- Token economics

- Market research

- Marketing and community building