ChatGPT in Finance: Streamlining Services and Customer Interactions

The financial industry is undergoing a significant transformation, with the integration of artificial intelligence (AI) and conversational AI virtual assistants like ChatGPT taking center stage. These advanced technologies are revolutionizing the way financial institutions interact with customers and provide services, enhancing efficiency, personalization, and customer satisfaction.

Streamlined Services and Automation:

ChatGPT empowers financial institutions to streamline their service offerings by automating routine and repetitive tasks. Through natural language processing, ChatGPT can handle customer queries, provide financial advice, and process transactions with remarkable accuracy and speed. This automation frees up human agents to focus on complex and value-added tasks, improving productivity and reducing operational costs.

Enhanced Customer Interactions:

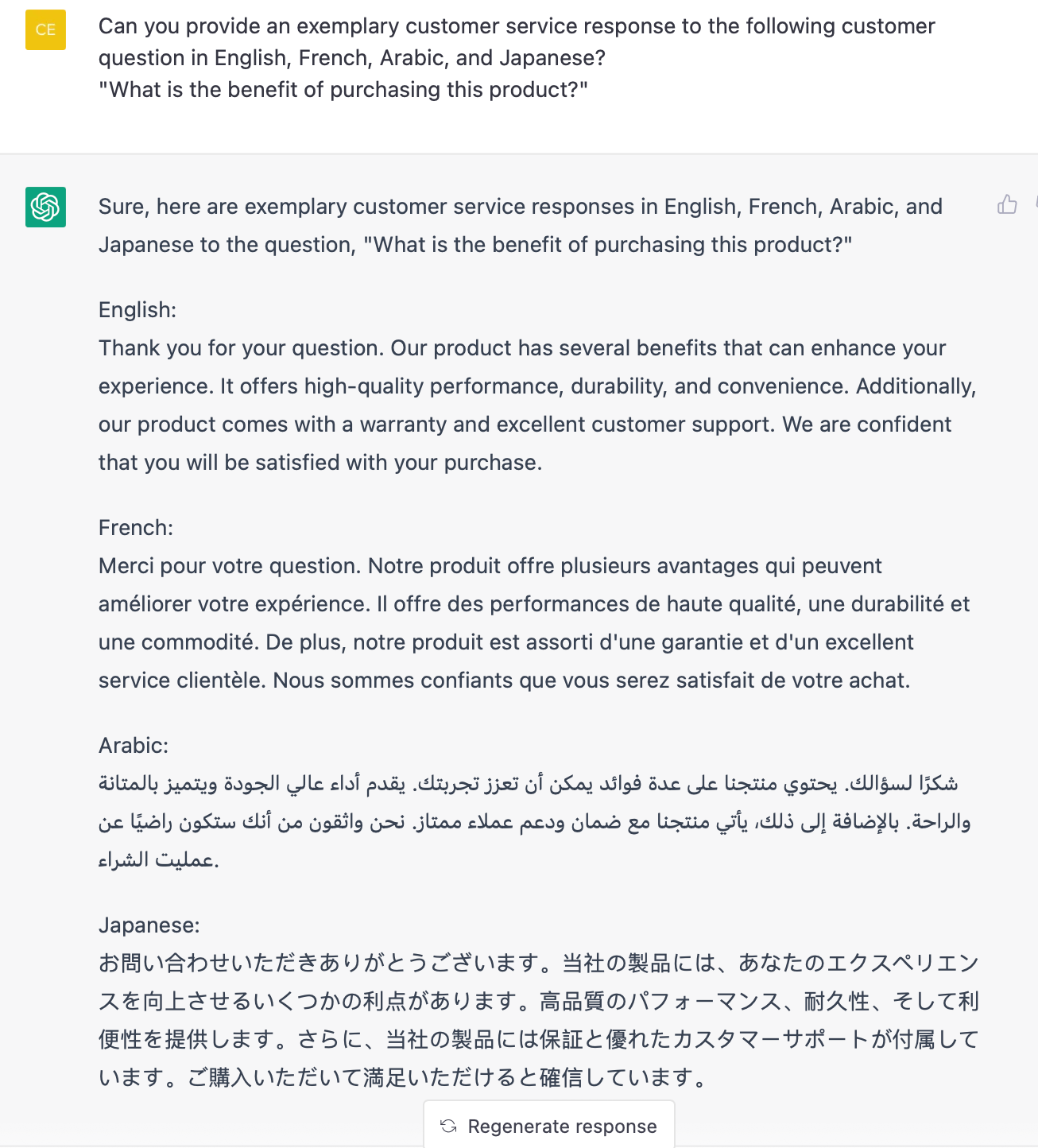

ChatGPT’s conversational AI capabilities enable financial institutions to engage with customers in a personalized manner. By understanding the customer’s intent and providing tailored responses, ChatGPT humanizes financial interactions and creates a seamless user experience. It can offer 24/7 support, answer questions promptly, and provide personalized recommendations based on individual financial circumstances.

Improved Financial Literacy:

ChatGPT can play a crucial role in enhancing financial literacy among customers. It can provide simplified explanations of complex financial concepts, assist with financial planning, and guide users through critical decisions related to investments, loans, and savings. By empowering customers with financial knowledge, ChatGPT fosters responsible financial habits and promotes long-term financial well-being.

Increased Accessibility:

The use of ChatGPT expands the accessibility of financial services, particularly for underserved communities. Individuals who prefer digital channels over traditional in-person interactions or face language barriers can seamlessly access financial information and support through conversational AI. This democratizes access to financial services, fostering greater financial inclusion.

Enhanced Risk Management:

ChatGPT can contribute to enhanced risk management within financial institutions. By analyzing vast amounts of data, ChatGPT can identify unusual patterns and potential risks, enabling proactive measures to mitigate losses. It can also assist in detecting fraudulent activities and safeguarding customers’ financial assets.

Overall, the integration of ChatGPT in finance is driving significant advancements by streamlining services, enhancing customer interactions, and promoting financial literacy. As AI technology continues to evolve, ChatGPT’s potential in the financial sector is vast, promising to revolutionize the way financial institutions operate and serve their customers.