Bridging Real-world Assets and Digital Currencies: The Role of New Tokens

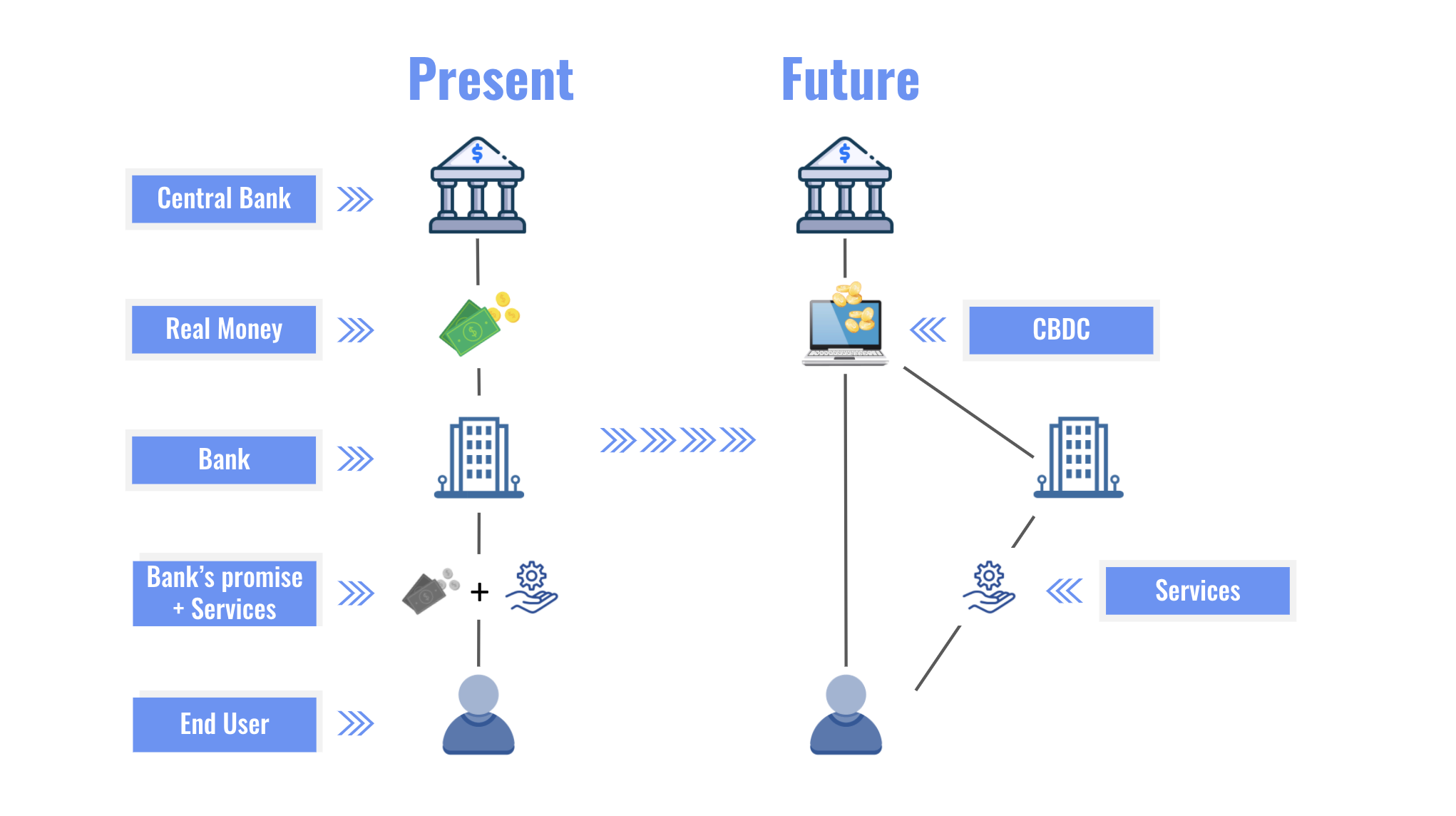

The emergence of blockchain technology and digital currencies has opened up new possibilities for bridging the gap between real-world assets and the digital realm. New types of tokens, known as asset-backed tokens or security tokens, are emerging as a key tool in this process.

Asset-Backed Tokens

Asset-backed tokens are digital representations of real-world assets, such as real estate, commodities, or even fine art. They provide a way to tokenize ownership rights and facilitate secure and efficient trading of these assets. By representing a fraction of a physical asset, asset-backed tokens allow investors to access a wider range of investment opportunities with greater flexibility.

Security Tokens

Security tokens are similar to traditional securities such as stocks and bonds. They represent ownership in a specific company or asset and can generate regular income or capital appreciation. However, unlike traditional securities, security tokens are issued on the blockchain, making them more transparent, secure, and accessible to a wider range of investors.

Benefits of New Tokens

The use of asset-backed and security tokens offers numerous benefits:

- Increased Accessibility: New tokens make real-world assets more accessible to smaller investors, who may not have the capital or expertise to invest directly in these assets.

- Enhanced Liquidity: Digital tokenization creates new markets for real-world assets, increasing their liquidity and making it easier to trade them in real-time.

- Reduced Transaction Costs: Blockchain-based transactions eliminate intermediaries, reducing transaction fees and increasing efficiency.

- Transparency and Security: New tokens are built on distributed ledger technology, ensuring transparency and security in transactions, protecting investors from fraud and counterfeiting.

Examples of Use Cases

New tokens are already being used in various real-world applications, including:

- Real Estate: Tokenization of real estate assets allows for fractional ownership, making it more affordable for individuals to invest in properties.

- Commodities: Commodities such as precious metals and agricultural products can be tokenized, facilitating easier trading and hedging strategies.

- Intellectual Property: Music royalties, patents, and other intellectual property can be represented as tokens, providing creators with new revenue streams.

Conclusion

Asset-backed and security tokens play a crucial role in bridging real-world assets and digital currencies. They offer enhanced accessibility, liquidity, reduced costs, and increased security, unlocking new financial opportunities for investors and transforming various industries. As blockchain technology continues to evolve, the use of new tokens is likely to expand further, revolutionizing the financial ecosystem and creating a more inclusive and efficient global economy.## Bridging Real-world Assets And Digital Currencies: The Role Of New Tokens

Executive Summary

The convergence of real-world assets and digital currencies is revolutionizing the financial landscape. The emergence of tokenization, a process that represents physical assets as digital tokens on a blockchain, is at the forefront of this transformation. Tokenization not only enables secure and transparent fractional ownership of assets but also offers unique advantages in areas such as accessibility, liquidity, and capital raising in new markets previously not possible.

Introduction

Digital assets and real-world assets traditionally reside in separate domains. Tokenization bridges this gap by creating digital representations of real-world assets on a blockchain network, facilitating a seamless integration of these two worlds. This union paves the way for innovative financial solutions and revitalizes the global financial ecosystem.

Subtopics and Descriptions

Security and Transparency

Tokenization enhances the security of real-world assets through the immutability and transparency of blockchain technology. Transactions are recorded on a distributed ledger, ensuring an auditable, tamper-proof history of ownership.

- Immutable transaction records protect against unauthorized modifications or fraudulent activities.

- Transparent ledger provides a clear audit trail of all transactions, increasing accountability and trust.

- Decentralized network eliminates single points of failure, mitigating risks associated with centralized ownership.

Fractional Ownership

Tokenization enables fractional ownership of assets, making previously inaccessible investments available to a broader audience. This democratized access opens up new investment opportunities and promotes financial inclusion.

- Allows for smaller investments in high-value assets, such as real estate or artwork.

- Facilitates the creation of diversified portfolios that were once challenging to assemble.

- Enables investors to tailor their investments to specific risk appetites and investment goals.

Liquidity

Tokenized assets have increased liquidity compared to their physical counterparts due to the accessibility provided by digital marketplaces. This liquidity enhancement enables quick and efficient trading, reducing transaction costs and attracting investors seeking greater flexibility.

- Instant settlement of trades eliminates delays associated with traditional asset transfers.

- Continuous trading markets provide greater opportunities for liquidity and risk management.

- Transparent pricing mechanisms ensure fair value and reduce information asymmetry between buyers and sellers.

Capital Raising

Tokenization offers new avenues for capital raising in real-world asset sectors. By tapping into global investor bases and democratizing access to investments, businesses can unlock additional sources of funding.

- Issuance of asset-backed tokens allows companies to raise capital without traditional intermediaries.

- Low issuance costs and simplified processes reduce barriers to capital formation.

- Access to a wider pool of investors through digital marketplaces expands fundraising opportunities.

Global Reach

Tokenization opens up new markets for real-world asset investment by overcoming geographical barriers. Digital marketplaces enable cross-border transactions, attracting global investors and diversifying investment portfolios.

- Borderless access to assets allows investors to invest in overseas markets previously out of reach.

- Virtual trading platforms connect investors from different jurisdictions, enhancing liquidity.

- Harmonized regulatory frameworks facilitated by tokenization promote cross-border investment activities.

Conclusion

The integration of real-world assets and digital currencies through tokenization is transforming the financial landscape. Enhanced security, fractional ownership, increased liquidity, expanded capital raising opportunities, and global reach empower new financial solutions and unlock new investment horizons. As tokenization technology matures and regulatory frameworks evolve, we can expect even more transformative applications and a future where digital currencies seamlessly interact with the assets that underpin our physical world.

Keyword Tags

- Tokenization

- Real-world Assets

- Digital Currencies

- Blockchain

- Fractional Ownership

FAQs

-

How can tokenization increase the security of real-world assets?

- Blockchain technology provides an immutable and transparent ledger, protecting against unauthorized modifications and enhancing accountability.

-

What are the advantages of fractional ownership enabled by tokenization?

- Fractional ownership democratizes access to investments by allowing smaller investments in high-value assets and facilitating portfolio diversification.

-

How does tokenization improve liquidity in real-world asset markets?

- Digital marketplaces offer continuous trading and attract global investors, reducing transaction costs and providing greater flexibility.

-

Can tokenization help businesses raise capital more efficiently?

- Asset-backed token issuance allows companies to raise capital without traditional intermediaries, simplifying processes and lowering costs.

-

How does tokenization facilitate global investment in real-world assets?

- Virtual trading platforms and harmonized regulatory frameworks enable cross-border transactions, attracting global investors and diversifying investment portfolios.