Blockchain In Real Estate: Transforming Property Transactions

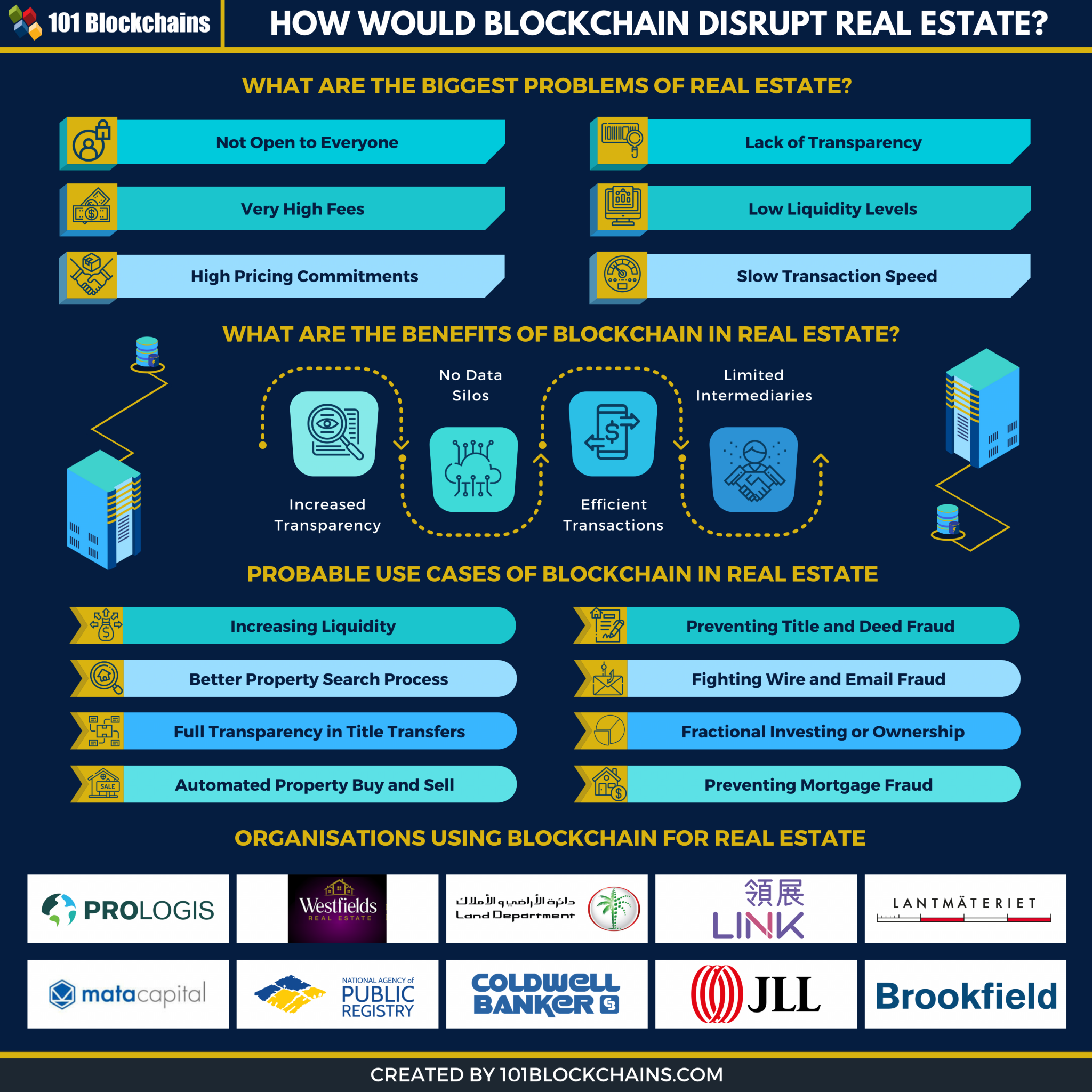

Blockchain technology has the potential to revolutionize the real estate industry, offering numerous benefits that can enhance the efficiency, transparency, and security of property transactions.

-

Enhanced Efficiency: Blockchain technology streamlines and automates various processes involved in real estate transactions. By creating a tamper-proof digital ledger, blockchain eliminates the need for manual paperwork and intermediaries, reducing the time and effort required to complete transactions.

-

Increased Transparency: Blockchain provides an immutable and transparent record of all transactions. This eliminates the risk of fraud and manipulation, as any changes or updates to the ledger are visible to all participants in the network.

-

Improved Security: The decentralized nature of blockchain makes it extremely secure. Data is stored across a vast network of computers, making it virtually impossible to hack or manipulate. This ensures the integrity and authenticity of property records.

-

Faster Transactions: Blockchain eliminates the need for lengthy and bureaucratic processes involved in traditional real estate transactions. By automating and streamlining various steps, blockchain significantly reduces the time required to complete property transactions.

-

Lower Costs: The removal of intermediaries and automation of processes reduces the overall costs associated with property transactions. Blockchain allows for peer-to-peer transactions, eliminating the need for expensive intermediaries such as lawyers and brokers.

-

Simplified Ownership Verification: Blockchain provides a secure and tamper-proof way to store property ownership records. This makes it easier to verify ownership and transfer properties, reducing the risk of property disputes and fraud.

-

Empowering Smart Contracts: Blockchain enables the use of smart contracts, which are self-executing contracts stored on the blockchain. Smart contracts automate the execution of specific terms and conditions in property transactions, reducing the need for legal documentation and ensuring the impartial execution of agreements.

-

Facilitating Fractional Ownership: Blockchain makes it possible to tokenize real estate assets, allowing multiple investors to own fractional shares in a property. This opens up the real estate market to a wider pool of investors and provides greater liquidity for investors.

In summary, blockchain technology offers significant advantages that can transform property transactions, making them more efficient, transparent, secure, and cost-effective. As the technology matures and adoption increases, it is expected to play a transformative role in the real estate industry.## Blockchain In Real Estate: Transforming Property Transactions

Executive Summary

The real estate industry is undergoing a technological revolution, driven by the adoption of blockchain technology. Blockchain is a distributed, secure ledger that can record and track transactions, making it an ideal platform for managing the complex and often opaque processes involved in real estate transactions.

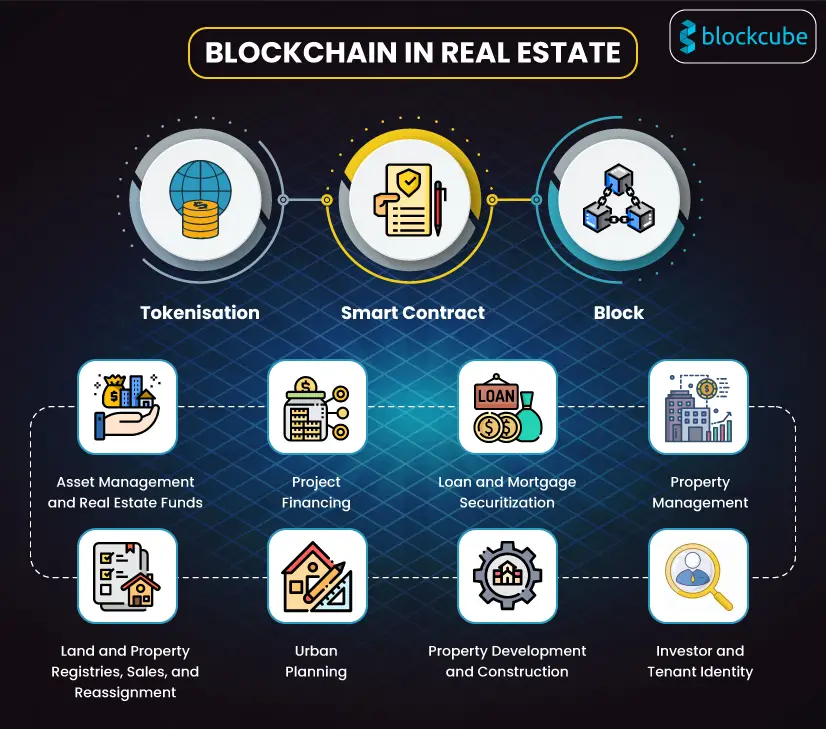

This article explores the transformative potential of blockchain in real estate, discussing five key subtopics:

- Smart Contracts

- Tokenization

- Property Management

- Fractional Ownership

- Title Registry

By leveraging the unique capabilities of blockchain, real estate professionals can streamline transactions, reduce costs, improve transparency, and enhance security. As blockchain adoption in real estate continues to grow, it is poised to revolutionize the way properties are bought, sold, and managed.

Introduction

The real estate industry is notoriously complex, characterized by high transaction costs, lengthy processes, and a lack of transparency. These challenges have long plagued the industry, hindering its accessibility and efficiency. However, the emergence of blockchain technology offers a promising solution, providing a secure and efficient platform for managing real estate transactions.

Smart Contracts

Smart contracts are self-executing contracts stored on the blockchain. They facilitate the automatic execution of predetermined conditions, reducing the need for intermediaries and manual processes.

- Enforceability: Smart contracts are legally binding, ensuring that the terms and conditions of the contract are met.

- Transparency: The code of smart contracts is open for all parties to review, enhancing transparency and accountability.

- Efficiency: They automate processes, reducing transaction time and costs.

Tokenization

Tokenization involves representing real estate assets as digital tokens on the blockchain. This process allows for the fractional ownership of properties, enabling investors to participate in real estate without the need for large down payments.

- Increased Liquidity: Tokenization provides 24/7 liquidity, allowing investors to buy and sell real estate tokens more easily.

- Accessibility: It democratizes real estate investment by making it accessible to a wider range of investors.

- Transparency: The token issuance process is recorded on the blockchain, ensuring transparency and auditability.

Property Management

Blockchain can revolutionize property management by providing a shared and secure platform for managing property records, maintenance requests, and tenant communication.

- Simplified Communication: Facilitate seamless communication between tenants, owners, and property managers through a centralized platform.

- Enhanced Efficiency: Automate maintenance requests and rent collection, reducing manual processes and improving operational efficiency.

- Transparency: Provide a single, immutable source of truth for property records, reducing disputes and enhancing transparency.

Fractional Ownership

Blockchain enables fractional ownership of properties, allowing multiple investors to co-own a single asset. This concept opens up real estate investment opportunities to individuals who may not have the financial means to purchase an entire property on their own.

- Reduced Barriers to Entry: Lower the cost of entry for investors, making real estate investment more accessible.

- Increased Diversification: Allows investors to diversify their portfolios by owning shares in multiple properties.

- Enhanced Liquidity: Tokenized fractional ownership provides increased liquidity for investors who need to sell their shares.

Title Registry

Blockchain can serve as a secure and immutable title registry, streamlining the property ownership verification process and reducing the risk of fraud.

- Simplified Verification: Provide real-time access to ownership records, simplifying title verification and due diligence processes.

- Increased Security: Blockchain’s cryptographic nature safeguards title records from tampering and forgery.

- Reduced Costs: Eliminate the need for physical title deeds and intermediaries, reducing transaction costs.

Conclusion

Blockchain technology has the transformative potential to revolutionize the real estate industry, addressing long-standing challenges and unlocking new possibilities. By embracing blockchain, real estate professionals can enhance efficiency, reduce costs, increase transparency, and improve security. As blockchain adoption in real estate continues to grow, it is poised to shape the future of property transactions, making the industry more accessible, equitable, and secure.

Keyword Tags

- Blockchain

- Real Estate

- Smart Contracts

- Tokenization

- Digital Asset

FAQ

1. Is blockchain technology secure?

Blockchain is inherently secure due to its decentralized nature and advanced cryptography, making it highly resistant to hacking and fraud.

2. How can blockchain reduce costs in real estate transactions?

Blockchain automates processes, eliminates intermediaries, and reduces the need for paper-based documentation, leading to significant cost savings.

3. What types of real estate assets can be tokenized?

Virtually any type of real estate asset can be tokenized, including residential properties, commercial buildings, and land parcels.

4. How does fractional ownership through blockchain work?

Blockchain platforms allow for the creation of digital tokens representing fractional shares of a real estate asset, offering lower entry barriers to investors.

5. Can blockchain streamline property management?

Blockchain can provide a centralized, immutable platform for property management, simplifying communication, automating tasks, and enhancing transparency.