Analyzing The Market: The Impact Of New Cryptocurrencies On Digital Finance

The emergence of cryptocurrencies has had a profound impact on the landscape of digital finance. These virtual currencies have revolutionized the way individuals and businesses transfer and store value. Moreover, they have introduced new opportunities for investment and financial innovation.

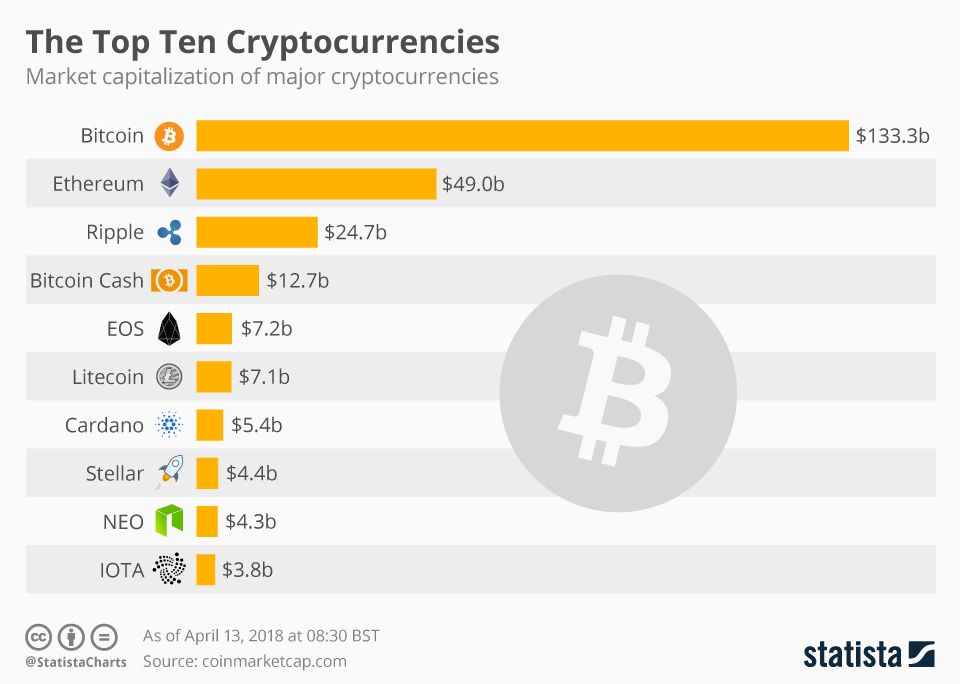

One of the key impacts of new cryptocurrencies is the diversification of digital finance. In the past, Bitcoin was the dominant cryptocurrency, but the rise of alternative coins (altcoins) has provided investors with a broader range of choices. Altcoins offer a diversity of features and use cases, catering to specific niches within the digital finance market. This diversification has increased competition and innovation, ultimately benefiting both investors and users.

Furthermore, the surge in popularity of new cryptocurrencies has created new opportunities for investment. Digital asset exchanges and investment platforms have emerged to facilitate trading in cryptocurrencies. This has made it easier for individuals to access and invest in the cryptocurrency market, potentially resulting in higher returns and increased financial inclusion.

Beyond their role in facilitating payments and investments, new cryptocurrencies have also paved the way for new financial applications. Decentralized finance (DeFi) is an emerging ecosystem of protocols and applications built on blockchain technology. DeFi protocols allow users to lend, borrow, and earn interest on their crypto assets without relying on traditional financial intermediaries. This has the potential to increase accessibility to financial services and challenge the dominance of traditional banking models.

However, it is essential to acknowledge that the rapid growth of new cryptocurrencies has also brought challenges. Volatility remains a concern, and the lack of regulation in many markets has led to concerns about market manipulation and investor protection. Additionally, the anonymity provided by cryptocurrencies can facilitate illegal activities, such as money laundering and terrorism financing.

In conclusion, the impact of new cryptocurrencies on digital finance has been significant. These virtual currencies have diversified the market, created new investment opportunities, and facilitated the emergence of innovative financial applications. However, ongoing challenges related to volatility and regulation need to be addressed to ensure the long-term viability of the cryptocurrency market and its role in digital finance.## Analyzing The Market: The Impact Of New Cryptocurrencies On Digital Finance

Executive Summary

The emergence of new cryptocurrencies is disrupting the digital finance landscape, posing challenges and opportunities for investors, businesses, and governments. This article examines the impact of these novel cryptocurrencies on key aspects of digital finance, including market dynamics, regulatory frameworks, and technological advancements.

Introduction

With the advent of Bitcoin in 2024, the digital finance landscape has undergone a paradigm shift. The subsequent proliferation of cryptocurrencies has further accelerated the transformation, raising questions about the future of traditional finance. This article delves into the complexities of this emerging market, exploring the implications of new cryptocurrencies on various facets of digital finance.

FAQs

-

What are the unique characteristics of new cryptocurrencies?

- Decentralized: Built on blockchain technology, they operate independently of central authorities.

- Anonymous: Transactions are typically pseudonymized, providing privacy and security.

- Scarce: Many new cryptocurrencies have limited issuance quantities, leading to potential appreciation in value.

-

What are the regulatory implications of new cryptocurrencies?

- Uncertainty: Governments worldwide are still grappling with the classification and regulation of cryptocurrencies.

- Anti-Money Laundering (AML): Regulatory frameworks are being developed to prevent cryptocurrencies from being used for illicit activities.

- Taxation: Tax authorities are considering how to treat cryptocurrency transactions and earnings.

-

What are the technological advancements associated with new cryptocurrencies?

- Blockchain Development: New cryptocurrencies are often built on advanced blockchain protocols, improving scalability, security, and efficiency.

- Smart Contracts: Cryptocurrencies are integrated with smart contracts, enabling the automation and enforcement of agreements.

- Decentralized Finance (DeFi): New cryptocurrencies facilitate peer-to-peer lending, automated market making, and other financial services without intermediaries.

Impact on Market Dynamics

-

Disruption of Traditional Finance: New cryptocurrencies challenge the dominance of traditional financial institutions, introducing competition and driving innovation.

- Decentralized Payment Systems: Cryptocurrencies allow for direct, low-cost cross-border payments.

- Alternative Investment Opportunities: New cryptocurrencies provide diversification options and potential for high returns.

- Competition for Market Share: Traditional financial institutions are compelled to adapt and offer cryptocurrency-related services.

-

Increased Liquidity and Accessibility: New cryptocurrencies create additional liquidity pools and make financial markets accessible to previously excluded populations.

- Global Financial Inclusion: Cryptocurrency platforms facilitate financial inclusion for individuals in regions with limited access to traditional banking.

- Reduced Transaction Costs: Decentralized exchanges and peer-to-peer networks enable low-cost trading and remittances.

- Increased Trading Volume: The introduction of new cryptocurrencies has contributed to a surge in trading volume in digital finance markets.

-

Market Volatility and Speculation: The nascent nature of new cryptocurrencies often leads to high market volatility and speculative behavior.

- Price Fluctuations: New cryptocurrencies can experience significant price swings, making them attractive to speculative investors.

- FOMO and Panic Selling: Investors driven by fear of missing out (FOMO) rush into markets, leading to price bubbles and subsequent sell-offs.

- Regulation and Governance: Regulatory uncertainty and the lack of governance frameworks contribute to market instability.

Regulatory Considerations

-

Anti-Money Laundering and Know-Your-Customer (KYC) Compliance: Governments are implementing AML and KYC regulations to prevent illicit use of cryptocurrencies.

- Compliance Enforcement: Exchanges and other cryptocurrency service providers are required to implement robust compliance procedures.

- Due Diligence: AML/KYC measures require businesses to verify the identities of customers and monitor transactions for suspicious activity.

- Collaboration with Law Enforcement: Authorities are collaborating with cryptocurrency industry leaders to combat money laundering and other financial crimes.

-

Taxation of Cryptocurrency Transactions: Governments are grappling with how to tax cryptocurrency earnings and transactions.

- Capital Gains Tax: Profits from cryptocurrency trading are subject to capital gains tax in many jurisdictions.

- Income Tax: Some countries treat cryptocurrency mining and staking as taxable income.

- Tax Avoidance and Evasion: The anonymous nature of cryptocurrencies can pose challenges to tax compliance.

-

Regulatory Uncertainty and Compliance Challenges: The absence of clear regulatory frameworks creates uncertainty and compliance challenges for businesses in the cryptocurrency sector.

- Legal Gray Areas: The rapid evolution of the market often outpaces regulatory developments, leaving businesses in legal gray areas.

- Regulatory Licensing: Businesses operating in the cryptocurrency space may require licenses or registrations in certain jurisdictions.

- Cross-Jurisdictional Compliance: Global businesses face challenges in complying with varying regulations across jurisdictions.

Technological Advancements

-

Blockchain Innovations: New cryptocurrencies often leverage advanced blockchain protocols.

- Enhanced Security: Distributed ledger technology provides tamper-proof and immutable transaction records.

- Scalability and Efficiency: New blockchain protocols optimize block sizes, transaction confirmation times, and gas fees.

- Smart Contract Capabilities: Cryptocurrencies integrate with smart contracts, enabling automated workflows and conditional payments.

-

Decentralized Finance (DeFi) Applications: DeFi applications unlock a range of financial services on the blockchain.

- Peer-to-Peer Lending: DeFi platforms facilitate lending and borrowing without intermediaries.

- Automated Market Making (AMM): AMM platforms match buy and sell orders, providing decentralized liquidity.

- Yield Farming and Staking: DeFi users can earn rewards for providing liquidity or holding certain cryptocurrencies.

-

Interoperability and Cross-Chain Transactions: New cross-chain protocols allow for the transfer of value and communication between different blockchain ecosystems.

- Seamless Cross-Chain Transactions: Users can move assets across different chains without intermediary conversion.

- Extended DeFi Opportunities: Cross-chain protocols enable the utilization of DeFi services across multiple chains.

- Enhanced Market Efficiency: Interoperable blockchains minimize friction and optimize resource allocation.

Conclusion

The emergence of new cryptocurrencies has injected profound changes into the digital finance landscape. While these novel assets offer potential for market disruption and technological advancements, they also present challenges and complexities. Navigating the uncharted waters of cryptocurrency regulation, market volatility, and technological frontiers requires a comprehensive understanding of the evolving dynamics. As this market matures, governments, businesses, and investors must collaborate to foster stability, promote innovation, and harness the transformative potential of new cryptocurrencies in shaping the future of digital finance.

Keywords: New Cryptocurrencies, Digital Finance, Market Dynamics, Regulatory Considerations, Technological Advancements