AI in Financial Services: Risk Management and Fraud Detection

Artificial intelligence (AI) is rapidly transforming the financial services industry, and one of the most promising areas of application is in risk management and fraud detection. AI techniques can be used to analyze vast amounts of data to identify patterns and trends that would be impossible for humans to spot on their own. This can help financial institutions to better manage risk and prevent fraud, saving them money and protecting their customers.

Risk Management

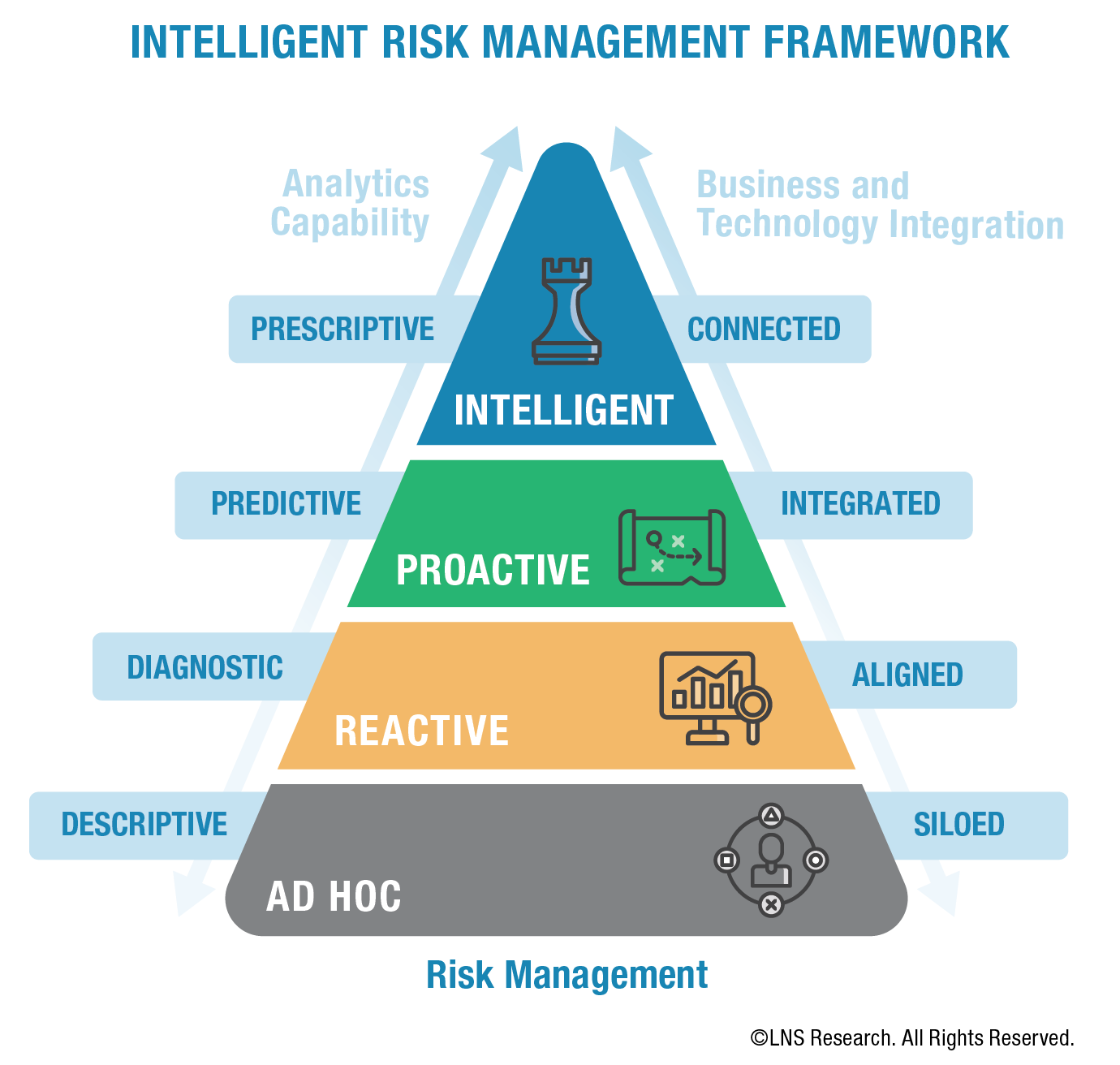

One of the most important applications of AI in risk management is in the identification of potential risks. AI techniques can be used to analyze data from a variety of sources, such as financial statements, market data, and news reports, to identify patterns that may indicate a potential risk. This information can then be used to develop risk mitigation strategies to reduce the impact of the risk.

For example, AI can be used to analyze financial statements to identify companies that are at risk of default. This information can then be used to make informed decisions about lending and investing. AI can also be used to analyze market data to identify potential market risks, such as bubbles or crashes. This information can then be used to make informed decisions about trading and investment strategies.

Fraud Detection

AI is also being used to combat fraud in the financial services industry. AI techniques can be used to analyze data from a variety of sources, such as transaction logs, customer data, and social media, to identify patterns that may indicate fraudulent activity. This information can then be used to develop fraud detection systems that can identify and flag suspicious transactions.

For example, AI can be used to analyze transaction logs to identify transactions that are inconsistent with the customer’s normal spending patterns. This information can then be used to flag the transaction for review and to determine if it is fraudulent. AI can also be used to analyze customer data to identify customers who are at risk of fraud. This information can then be used to implement targeted fraud prevention measures.

The use of AI in risk management and fraud detection is still in its early stages, but it has the potential to revolutionize the financial services industry. By automating the analysis of vast amounts of data, AI can help financial institutions to better manage risk and prevent fraud, saving them money and protecting their customers.## Ai In Financial Services: Risk Management And Fraud Detection

Executive Summary

Fraud detection and risk management are critical aspects of the financial industry, and financial institutions are increasingly turning to AI to automate these tasks and improve efficiency. AI can be used to detect fraud, identify risks, and automate compliance processes, which can help financial institutions save time and money while reducing the risk of financial loss.

Introduction

Over the past few years, AI has emerged as a powerful tool that has the potential to revolutionize a wide range of industries, including the financial services industry. AI can be used to automate tasks, make decisions, and identify patterns that humans would be unable to detect. This makes AI ideal for tasks such as fraud detection and risk management, which are critical to the financial services industry.

FAQs

- What is AI? Artificial Intelligence (AI) refers to the simulation of human intelligence processes by machines, especially computer systems. Specific applications of AI include expert systems, natural language processing, speech recognition and machine vision.

- How can AI be used in financial services? AI can be used in financial services for a variety of tasks, including fraud detection, risk management, and customer service.

- What are the benefits of using AI in financial services? AI can help financial institutions save time and money while reducing the risk of financial loss.

Subtopics

- Fraud Detection

- Detecting fraudulent transactions AI can be used to detect fraudulent transactions by analyzing spending patterns and identifying anomalies.

- Identifying suspicious behavior AI can be used to identify suspicious behavior by monitoring customer accounts for unusual activity.

- Preventing fraud AI can be used to prevent fraud by blocking suspicious transactions and taking other steps to protect customers.

- Risk Management

- Identifying risks AI can be used to identify risks by analyzing data and identifying patterns.

- Assessing risks AI can be used to assess risks by evaluating the likelihood and impact of potential events.

- Mitigating risks AI can be used to mitigate risks by implementing safeguards and taking other steps to reduce the likelihood and impact of potential events.

- Compliance

- Automating compliance processes AI can be used to automate compliance processes, such as KYC/AML checks and transaction monitoring.

- Identifying compliance risks AI can be used to identify compliance risks by analyzing data and identifying patterns.

- Monitoring compliance AI can be used to monitor compliance by tracking customer activity and identifying any potential violations.

- Customer Service

- Answering customer queries AI can be used to answer customer queries by using natural language processing and machine learning.

- Providing personalized recommendations AI can be used to provide personalized recommendations to customers by analyzing their spending patterns and preferences.

- Improving customer engagement AI can be used to improve customer engagement by providing personalized experiences and offering proactive support.

- Data Analysis

- Identifying trends AI can be used to identify trends by analyzing data and identifying patterns.

- Predicting future events AI can be used to predict future events by analyzing data and identifying patterns.

- Making decisions AI can be used to make decisions by analyzing data and identifying the best course of action.

Conclusion

AI is a powerful tool that has the potential to revolutionize the financial services industry. By automating tasks, making decisions, and identifying patterns that humans would be unable to detect, AI can help financial institutions save time and money while reducing the risk of financial loss. As AI technology continues to develop, it is likely to have an increasingly significant impact on the financial services industry.

Keyword Tags

- Artificial Intelligence

- Financial Services

- Fraud Detection

- Risk Management

- Compliance