AI and the Digital Transformation of Insurance

The insurance industry is undergoing a digital transformation, driven by the increasing use of artificial intelligence (AI) and other digital technologies. This transformation is having a profound impact on the way insurance companies operate and deliver their products and services.

How AI is Transforming the Insurance Industry

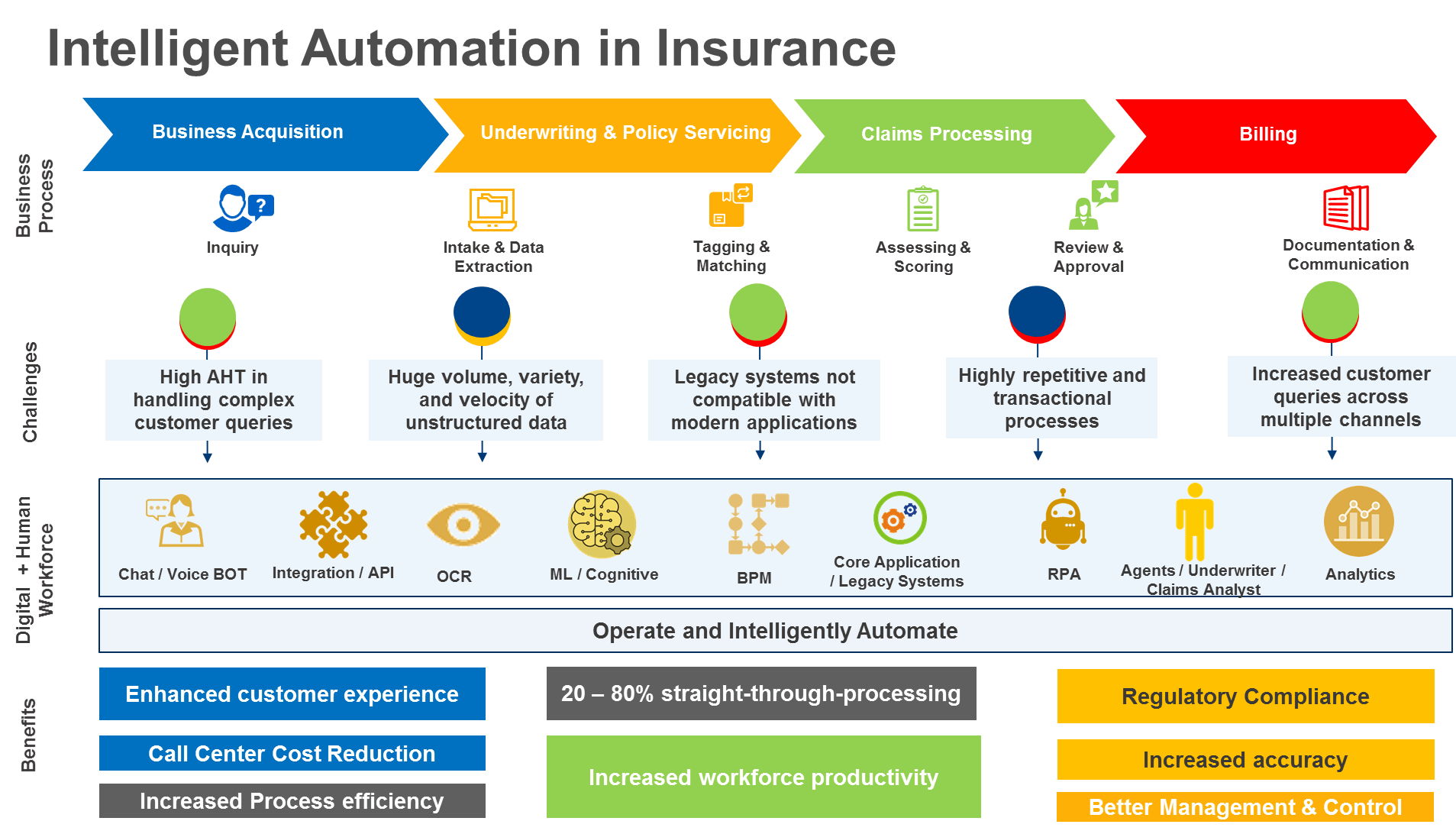

AI is being used in a variety of ways to transform the insurance industry. Some of the most common applications include:

–Underwriting: AI can be used to automate the underwriting process, making it faster and more efficient. AI-powered underwriting systems can analyze large amounts of data to identify risks more accurately and determine appropriate premiums.

–Claims processing: AI can be used to automate the claims processing process, reducing the time it takes to receive a payout. AI-powered claims processing systems can analyze data from police reports, medical records, and other sources to determine the validity of a claim and the appropriate payout amount.

–Fraud detection: AI can be used to detect fraud more effectively. AI-powered fraud detection systems can analyze data from claims, applications, and other sources to identify suspicious patterns that may indicate fraud.

–Customer service: AI can be used to improve customer service. AI-powered chatbots can be used to answer customer questions and resolve issues quickly and efficiently. AI-powered virtual assistants can also be used to provide personalized recommendations and advice to customers.

Benefits of AI for Insurance Companies

The use of AI offers a number of benefits for insurance companies, including:

–Reduced costs: AI can help insurance companies reduce costs by automating manual processes and improving efficiency. For example, AI-powered underwriting systems can reduce the time it takes to process an application, which can lead to lower administrative costs.

–Improved customer service: AI can help insurance companies improve customer service by providing faster and more personalized service. For example, AI-powered chatbots can be used to answer customer questions quickly and efficiently, and AI-powered virtual assistants can be used to provide personalized recommendations and advice to customers.

–Increased revenue: AI can help insurance companies increase revenue by enabling them to offer new products and services that meet the changing needs of customers. For example, AI-powered underwriting systems can enable insurance companies to offer more personalized policies at more competitive rates.

Challenges of AI for Insurance Companies

The use of AI also poses a number of challenges for insurance companies, including:

–Data privacy and security: AI systems require access to large amounts of data, which can pose a risk to data privacy and security. Insurance companies need to implement strong data security measures to protect customer data from unauthorized access and use.

–Bias and discrimination: AI systems can be biased against certain groups of people, such as minorities or people with disabilities. Insurance companies need to take steps to mitigate bias and discrimination in their AI systems.

–Lack of expertise: Many insurance companies lack the expertise needed to develop and implement AI systems. Insurance companies need to invest in training and development programs to build up their AI expertise.

Conclusion

The use of AI is transforming the insurance industry in a number of ways. AI is being used to automate processes, improve customer service, and increase revenue. However, the use of AI also poses a number of challenges, such as data privacy and security, bias and discrimination, and lack of expertise. Insurance companies need to be aware of these challenges and take steps to mitigate them in order to realize the full benefits of AI.

Imagine a world where your insurance policy is tailored just for you, based on your unique needs and habits. Thanks to AI, this dream is becoming a reality!

I’m not so sure about this whole AI thing. How can we trust machines to make decisions that affect our lives and finances?

AI is revolutionizing the insurance industry by streamlining processes, reducing costs, and providing personalized experiences. It’s a win-win situation for all.

I don’t buy it. AI is just a buzzword that insurance companies are using to jack up their prices. There’s no real substance behind it.

Oh, the irony! The insurance industry, which has a long history of being slow to adopt technology, is now at the forefront of the AI revolution.

Well, well, well. Looks like the insurance industry is finally waking up to the power of AI. About time, don’t you think?

I can’t wait for the day when my insurance policy comes with a virtual assistant that I can chat with about my coverage. ‘Hey Siri, increase my liability coverage by 10%’

I’m thrilled about the potential of AI in the insurance industry. It has the power to make insurance more accessible, affordable, and tailored to our individual needs.

I’m a bit concerned about the potential job losses in the insurance industry due to AI. What will happen to all those insurance agents and underwriters?

It’s important to note that AI is not meant to replace human insurance professionals. Instead, it will augment their capabilities and allow them to focus on more complex tasks.

I believe that AI has the potential to transform the insurance industry for the better. It can help us to get the coverage we need, when we need it, and at a price we can afford.